Changing Dynamics in the CLO Market

March 21, 2024

The collateralized loan obligation (CLO) market has generated strong performance during the past year, generating a total return of 9.85% over the 12-month period ending 2/29/2024.1 CLOs, which primarily pay floating-rate coupons, have benefited from rising interest rates relative to fixed rate securitized credit sectors.

Demand for CLOs from both institutional investors and retail investors — including exchange-traded funds (ETFs) — has remained strong into 2024 despite market expectations that the Federal Reserve will begin lowering interest rates this year. The discount margin (DM), or spread, for CLOs has steadily tightened over the past year, along with spreads for other fixed-income assets broadly.

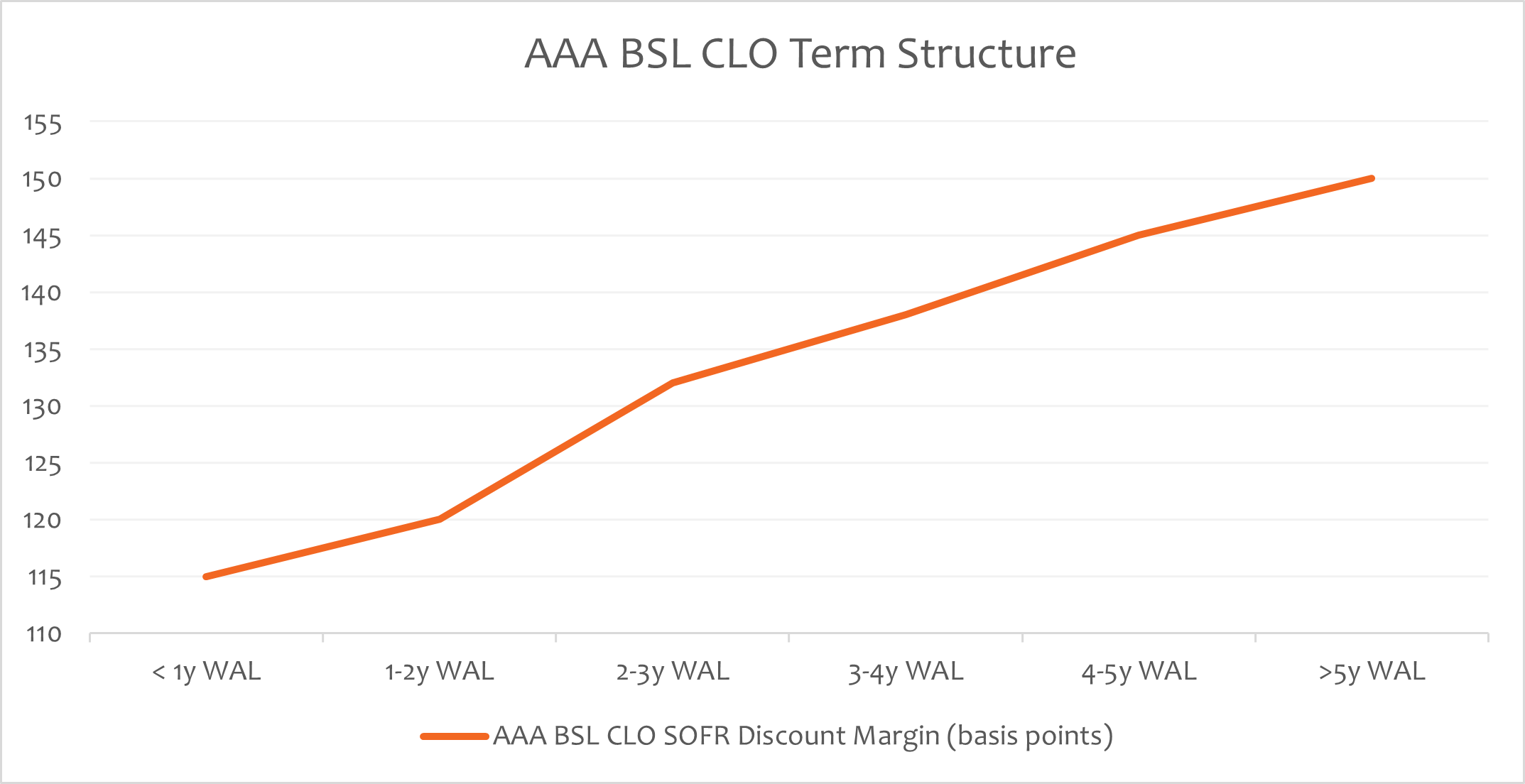

An emerging dynamic within the CLO market has been a steepening term structure, with shorter-term CLOs trading at tighter spreads relative to longer-term CLOs. Today’s Chart of the Week shows the current term structure for AAA-rated CLOs. Spreads for AAA broadly syndicated loan (BSL) CLOs are ranging on average from 115 DM for short, amortizing AAAs under 1-year weighted average life (WAL) to 150 DM for full-duration new issue AAAs with 6.5 year WAL.

Although CLO new issuance volumes have increased in response to market strength this year, new issue CLOs typically take six weeks on average to settle. Investors with money to put to work today, or who are having existing CLO holdings called away, are competing for a limited supply of remaining bonds in the secondary market. The strong CLO market technicals (supply/demand imbalances) have led to a significant portion of the AAA-rated CLO market now trading at a premium to par, leaving investors susceptible to call risk. Understanding methods to mitigate the call risk from CLO deals will be an important driver of total returns in the sector going forward.

Key Takeaway

The strong total returns and price appreciation within the CLO market during the past year have created new opportunities and risks in the sector. Our disciplined approach emphasizing strong credit fundamentals, attractive relative value and potential call risk within the sector has become increasingly important in light of the changing CLO market dynamics.

Source:

1J.P. Morgan CLOIE Index

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.