When the Dollar Shifts from Hedge to Risk

June 5, 2025

It has been a challenging year thus far for U.S. dollar-denominated financial assets. As of May 30, the S&P 500 Index is up a modest 1% year-to-date, and the Bloomberg U.S. Aggregate Bond Index has gained approximately 2%.1 However, the U.S. Dollar Index has declined by 8%,2 meaning returns for unhedged U.S. assets are weaker when viewed from a non-dollar perspective. Meanwhile, financial assets based in many other currencies have outperformed. Notably, gold, which is both a commodity and is “currency-like,” has surged 25% in dollar term year-to-date.3

Historically, the U.S. dollar has strengthened during periods of market stress, driven by the perception that dollar-denominated assets offer relative safety. In such environments, the dollar often acts as a natural hedge, with its strength helping to offset weakness in risk assets. At the start of the year, the dollar was expected to appreciate, particularly given the new administration’s tariff-driven trade policies, reminiscent of the 2018 U.S.-China trade conflict.

However, that narrative appears to be shifting. A combination of factors has weighed on the dollar’s performance: growth concerns triggered by tariffs, rising questions regarding the Federal Reserve’s independence, U.S. fiscal sustainability issues and Moody’s downgrade of U.S. Treasury credit ratings. Moreover, fiscal expansion and technological advances abroad, particularly in artificial intelligence, are contributing to a broader reassessment of the dollar's standing in global markets.

While the dollar is a free-floating currency influenced by many factors, the most straightforward explanation for its recent weakness could be foreign investors reducing their exposure to dollar-denominated assets accumulated over many years. According to the U.S. Department of the Treasury, foreign investors held approximately 33% ($8.2 trillion) of U.S. Treasuries, 27% ($4.2 trillion) of U.S. corporate bonds and 18% ($16.9 trillion) of U.S. equities as of June 30, 2024.4 However, there is little direct evidence to date of broad-based selling. Alternatively, investors may choose to hedge their currency exposure. Such hedging activity effectively involves selling dollars in forward markets, acting as a headwind for the currency. Another underappreciated factor is the frontloading of imports earlier this year in anticipation of tariffs. These transactions, settled mainly in dollars, likely led to a spike in foreign exporters converting dollars into local currencies, exerting downward pressure on the dollar.

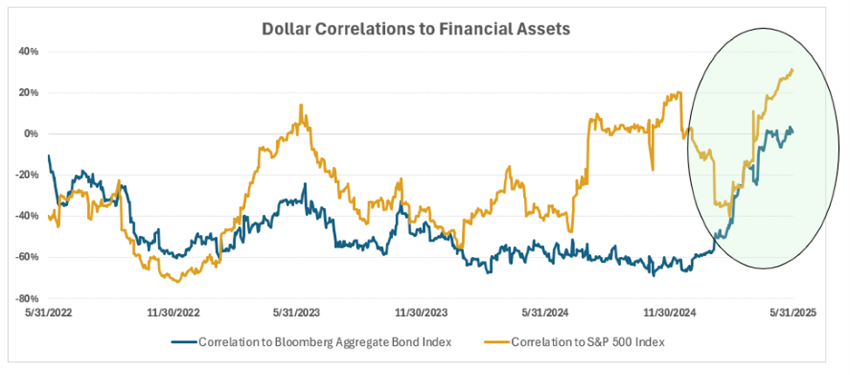

The recent dollar weakness carries meaningful implications for portfolio diversification. As illustrated in today’s Chart of the Week, correlations between the U.S. dollar and both equities and bonds have risen to the highest levels in the past three years. This surge in correlations increases portfolio volatility and undermines the dollar’s effectiveness as a hedge for global investors, posing challenges to traditional risk management frameworks. In response, many may look to reduce or hedge dollar exposure, potentially reinforcing the dollar's downward trend.

Key Takeaway

Ultimately, the strength of any free-floating currency depends on capital flows. While the dollar's depreciation this year is not entirely unexpected, considering its valuation and the high concentration of dollar-based assets globally, it introduces new challenges for global asset allocators. The dollar’s recent deviation from its traditional role as a safe-haven currency complicates portfolio diversification and risk management strategies. That said, I remain unconvinced that this episode poses a serious threat to the dollar’s status as the world’s reserve currency. The foundation of the dollar’s dominance remains the strength and resilience of the U.S. economy, which has historically outperformed and, in my view, is likely to continue doing so.

Sources:

1-3Bloomberg

4U.S. Department of the Treasury – Foreign Portfolio Holdings of U.S. Securities; 6/30/24

Index Definitions:

Bloomberg U.S. Aggregate Bond Index – An index that is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

S&P 500 Index – An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

U.S. Dollar Index – An index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.