Private Equity is Betting Big on Professional Sports

July 3, 2025

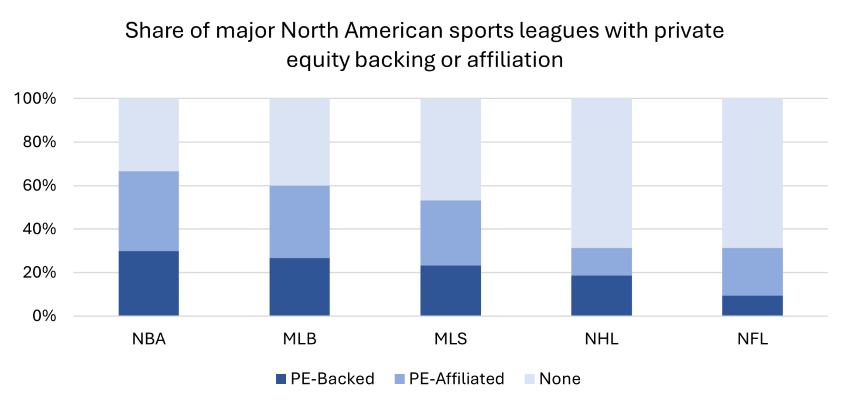

Traditionally restricted to ultra-wealthy individuals, sports franchise ownership is now accessible to institutional investors. Major leagues, including the National Basketball Association (NBA), Major League Baseball (MLB), National Hockey League (NHL) and Major League Soccer (MLS), have relaxed ownership rules, allowing private equity (PE) funds to acquire minority stakes. Once the most conservative league, the National Football League (NFL) joined this trend in 2024 by approving up to 10% PE ownership. These changes have created liquidity for existing minority owners and opened the door for billions in new investment from asset managers such as Arctos, Ares and CVC. As highlighted in today’s Chart of the Week, PE’s involvement in professional sports is significant and accelerating.

Recent team sales further highlight this shift. In June 2025, the Buss family, who had owned the Los Angeles Lakers since 1979, agreed to sell a majority stake of the team to Mark Walter, Chief Executive Officer of TWG Global and a minority owner since 2021, for a reported valuation of $10 billion, making it the largest sale of a U.S. sports franchise to-date. Earlier in 2025, the Boston Celtics were sold to a group led by PE investor Bill Chisholm for $6.1 billion, setting a new record for an NBA team sale at the time. And in 2023, a consortium led by Josh Harris, co-founder of Apollo Global Management, acquired the Washington Commanders for $6.05 billion, surpassing the previous record for an NFL team sale.1

As leagues have loosened ownership rules, PE funds have begun raising significant pools of capital to invest in sports and entertainment, with Ares, Arctos and RedBird each closing multibillion-dollar funds in recent years. Other large asset managers, including Sixth Street, TPG and Avenue Capital, have also launched dedicated vehicles. Even non-traditional entrants like Harbinger Sports Partners, backed by Mark Cuban and other industry veterans, are launching funds to acquire stakes in professional franchises.

But why the surge of interest in sports?

As investors seek uncorrelated sources of return, sports franchises have emerged as a unique and compelling investment opportunity due to their combination of strong brand equity, diversified and recurring revenue streams and scarcity, as most leagues are capped at around 30 teams. Sports have a universal appeal that crosses geographic, cultural and linguistic boundaries. Moreover, sports teams benefit from deeply loyal fan bases and consistent demand for live content, making them resilient even during economic downturns. They generate predictable cash flows from media rights, ticket sales, sponsorships and merchandise, many of which are underpinned by long-term contracts with built-in escalators. Some estimates show global sports market revenue in 2024 reached approximately $515 billion and is expected to grow to surpass $890 billion over the next decade.2 Streamers in particular have been prioritizing live sports in place of original scripted content in order to boost profitability. Amazon now spends around $3 billion annually on broadcasting rights and recently joined Disney and NBCUniversal in an 11-year, $77 billion NBA media deal.3

As previously mentioned, sports have demonstrated a low correlation with public markets, but they’ve also delivered strong growth-like returns. As measured by the Ross-Arctos Sports Franchise Index (RASFI), aggregate franchise valuations for the four largest North American leagues (MLB, NBA, NFL and NHL) have compounded at a rate of 14.9% over the past 10 years, outperforming the S&P 500 Index’s 12.5% annualized return by a wide margin, as of March 31, 2025.4

PE firms are positioning themselves as capital providers and as architects of the future sports economy by leveraging scale, digital innovation and global audience expansion to capture durable long-term value. As minority owners, PE firms are seeking to enhance value by investing in technology platforms, ranging from player performance analytics to dynamic ticket pricing, fan data collection and direct-to-consumer merchandising, in order to unlock value beyond game-day revenues.

PE’s influence isn’t just confined to traditional major leagues. There’s also growing enthusiasm around women’s sports and emerging leagues like pickleball, volleyball and e-sports. Private capital is funding infrastructure and name, image and likeness platforms in college sports as NCAA policies shift, opening new opportunities to monetize student-athlete content and reshape collegiate athletics.

Key Takeaway

The NBA, MLB, NHL and, more recently, the NFL have loosened ownership restrictions to accommodate institutional capital, enabling PE funds to take minority stakes and consolidate positions across multiple teams and leagues. PE’s presence in professional sports has surged as a result, as investors increasingly view teams not just as trophies, but as scalable, long-duration assets with multiple monetization levers. Limited franchise supply, rising media rights and global brand power make sports teams attractive investment vehicles. For PE investors, these dynamics offer both downside protection and upside potential through operational improvements, digital monetization and adjacent opportunities in areas like sports betting, real estate and streaming.

Sources:

1ESPN – Lakers’ $10 billion purchase tops record U.S. sports team sales; 06/18/25

2EIN Presswire – Global Sports Market: Key Trends, Market Share, Growth Drivers, And Forecasts for 2025-2034; 06/23/25

3Reuters – Amazon Prime Video shifts focus to live sports to boost profits, The Information Reports; 01/24/25

4University of Michigan, Ross School of Business – Ross-Arctos Sports Franchise Index (RASFI); 07/01/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.