Halftime Report: CMBS Market Defies Headwinds with Supply Surge

July 10, 2025

The commercial mortgage-backed securities (CMBS) market has seen record issuance in the first half of the year at over $56.8 billion across 73 closed single-asset, single-borrower (SASB) and multi-borrower conduit transactions through June 30, 2025.1 SASBs have contributed $41.7 billion over 54 deals with conduit composing the remaining $15.0 billion (19 deals).2 Despite a slow start to the second quarter - with only seven transactions priced in April, compared to 14 in March3 - deal volume accelerated to close the first half of the year on pace to set a new high-water mark in the post-Great Financial Crisis era.

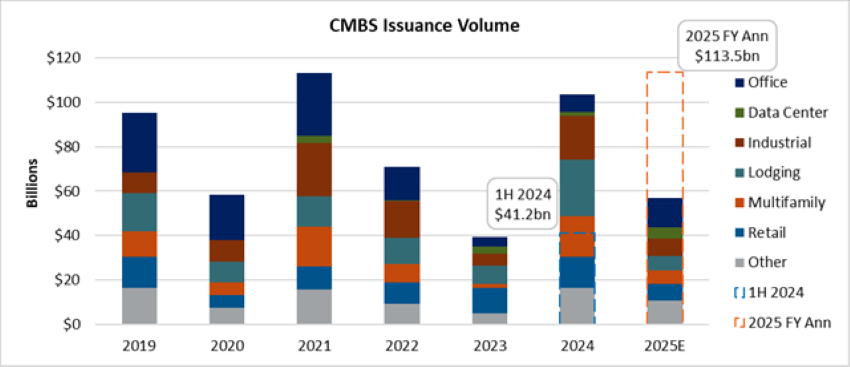

Today’s Chart of the Week highlights the strong pace of CMBS supply by asset class relative to recent history. At over $56.0 billion and counting, year-to-date volume is approximately 38% higher than the first half of 2024 ($41.2 billion) and has already surpassed full-year 2023 performance ($39.3 billion).4 Annualizing the total issuance from the first half of the year, 2025 could exceed 2021’s record-setting volume of $113.0 billion across 157 deals.5

The standout performer has been the office sector, which has seen exceptional supply concentrated in high-quality, Class-A collateral. The first quarter recorded its highest deal volume - nearly $10.0 billion - since the second quarter of 2021 ($11.6 billion).6 Through June 30, supply has outstripped office-related volume from 2023 and 2024 combined. Data centers have also continued their rise in popularity since the first large SASB debuted four years ago as owners and operators seek to expand financing options outside of the asset-backed securities (ABS) market. The first quarter saw approximately $4.5 billion in data center CMBS issuance, the highest on record.7

Despite positive supply technicals so far this year, headwinds for the CMBS market remain. Demand for lodging and industrial assets - two core CMBS sectors - has softened amid heightened market volatility and rising recession risks, which threaten the health of the U.S. consumer. In uncertain times, consumers often reduce spending on nonessential items such as leisure travel and discretionary goods. Given the heavy issuance in both lodging and industrial sectors through the end of last year, market participants may be reluctant to add incremental exposure to these segments.

Key Takeaway

While geopolitical and fiscal uncertainty will likely persist through year-end, the CMBS market continues to demonstrate resilience in the face of volatility. I expect the demand demonstrated for well-located office and data center assets with healthy rent rolls and strong, committed sponsors will continue through the end of the year, while allocations for sectors levered to consumer sentiment and spending patterns may stay constrained.

Sources:

1,2,4-7Trepp

3DB research

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.