Skinny Excess Returns for IG Corporates

July 17, 2025

Investment grade (IG) corporate credit spreads have come full circle since earlier this year. Remarkably, the spread widening that followed “Liberation Day” is a distant memory. In recent weeks, IG spreads have returned to a 76 option-adjusted spread (OAS), the tightest of the year, and only three basis points (bps) off of the tights since 2000, which we experienced in November 2024.1

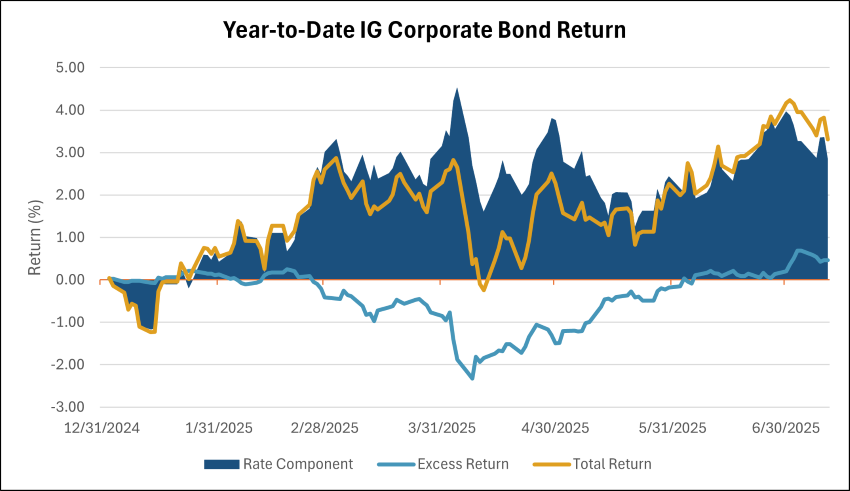

With this in mind, how much more can credit perform? Today’s Chart of the Week shows IG corporate credit performance year-to-date. Total returns have rebounded nicely; however, the majority of this performance is due to the move in interest rates. Corporate credit excess returns over duration-matched Treasuries have provided only 46 bps of return, while rates have provided 285 bps.2

There is a case to be made for caution here. Tariffs remain a potential catalyst for volatility, and the Trump administration has demonstrated that it can change direction on tariff policy quickly (e.g., European Union, Mexico). The overall pushback of tariff increases to August 1 remains an overhang and leaves the Federal Reserve’s path fairly uncertain, although the market is still pricing in two interest rate cuts in 2025.3

As we enter the early part of earnings season, customer resiliency in the face of the tariff backdrop and inflation outlook will be a focus. Broadly, earnings expectations for the second quarter are relatively modest. Company rating trends for non-financials are starting to turn as downgrades exceeded upgrades in the second quarter of 2025 for the first time since the first quarter of 2021.4 Therefore, analysts will closely scrutinize management team commentary on their ability to pass through price increases.

Technicals for the IG market continue to be very constructive. New issuance for the first half of 2025 was the second busiest ever, behind 2020, with close to $1 trillion issued.5 However, on a net basis, supply has been in the middle of the pack for the last 10 years.6 In addition, Lipper reported another week of strong inflows into IG funds of $1.7 billion, representing the 10th straight week of inflows totaling over $27 billion.7 Pension performance is also supportive of spreads. In the first half of 2025, the pension funded ratio reached 105.1%, which is the second highest level since the Global Financial Crisis, just below October 2022, and an increase from 103.6% at the start of the year.8 The more fully funded a pension is, the more likely they are to enter derisking trades into long-end credit.

Key Takeaway

While technicals and the bid for yield have significantly contributed to attaining the current IG corporate credit spread levels, it is difficult to envision significant excess returns in the near term. I expect spreads to remain rangebound as more clarity emerges surrounding the durability of the consumer and the ability of corporations to pass on increased costs.

Sources:

1-3Bloomberg

4J.P. Morgan

5-7Barclays

8Milliman – Pension Funding Index July 2025; 7/8/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.