Volatility Strikes Back — Revisited

July 31, 2025

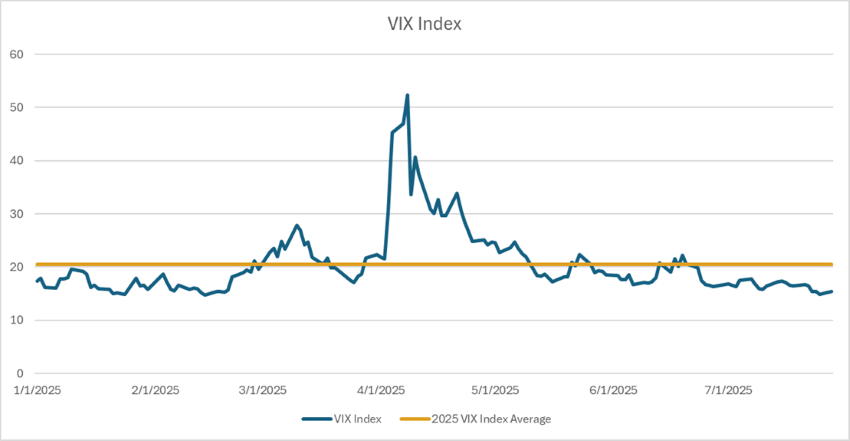

Earlier this year, I discussed the technical and fundamental reasons driving the higher levels of the Chicago Board Options Exchange Volatility Index (VIX) in 2025 compared to 2024. In the months since, there has been a significant amount of market activity. Today’s Chart of the Week revisits the state of the volatility market and the technical and fundamental drivers discussed earlier this year.

Since early April, the VIX spiked in the aftermath of “Liberation Day,” only to return to roughly the level at which it began the year.1 On the technical side, put skew has remained elevated. While the S&P 500 Index (SPX) has recovered and pushed to new highs, downside protection remains in demand as investors exhibit some caution regarding the economic environment. The general upward trend of the SPX since April has calmed the perception of volatility in the market,2 contributing to the move lower. Implied volatility tends to be negatively correlated to the market, which means it will likely decline as the market rallies.

On the fundamental side, easing trade tensions have contributed to a better outlook for economic growth. Tariff implementation has generally resulted in much lower levels than the initial shock investors witnessed on “Liberation Day.” The tariff war with China has also eased with both sides talking and pausing retaliatory tariffs. Alongside this, Congress passed a tax bill extending the expiring tax cuts initiated under the first Trump administration. The more benign tone around government policy has given equity markets room to breathe and rally off their April lows. This rally has generally been a grind upward, resulting in low realized volatility that in turn compresses implied volatility.

Key Takeaway

In my earlier piece, I expressed that the VIX should have a higher floor due to a feedback loop of negative news around trade causing market sell-offs and higher volatility. This feedback loop played out in March and April but has evolved in the months since. The equity market is undergoing a cycle of easing tensions, creating a slow grind higher in stock prices that compresses implied volatility. However, I still believe the VIX will exhibit a higher floor this year compared to last. Investor demand for downside protection remains prominent and helps establish a higher base for the VIX. The prospect of increased trade uncertainty is also looming. While the U.S. has paused tariffs on China, negotiations remain fluid and could change at any minute.

Sources:

1Bloomberg

2CNBC – S&P 500 Index; as of 7/29/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.