Private Capital Fundraising Takes a Breather

August 7, 2025

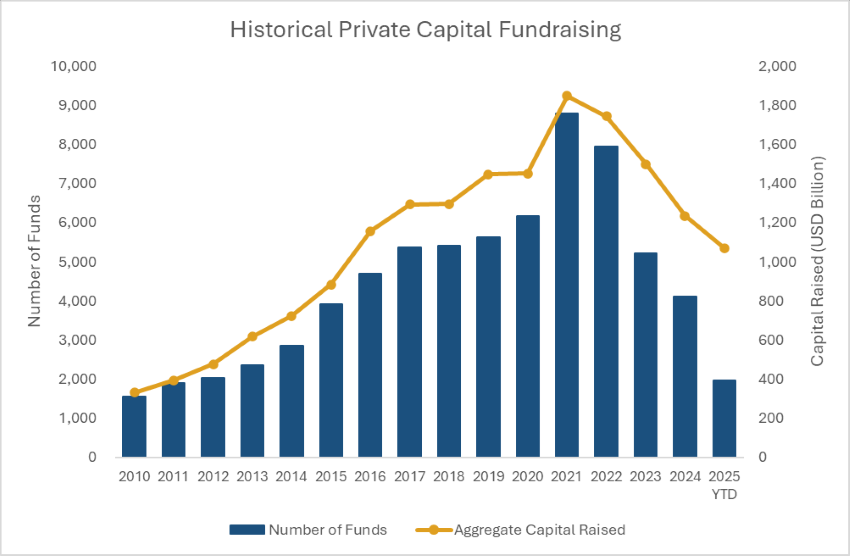

The growth of the private markets over the last 15 years has been astounding. Almost every asset class (venture capital, private equity, private credit, secondaries and more) has seen considerable growth in terms of capital raised, new firms created and fund vehicles launched. But that runaway growth did not last. Today’s Chart of the Week illustrates both the post-COVID boom and the slowdown that followed, brought on by a lack of liquidity and distributions across the private market, a minimal number of initial public offerings (IPOs), volatile interest rate and merger & acquisition (M&A) environment and, most recently, uncertainty around tariffs.

In 2021, almost 9,000 funds were raised (roughly $1.8 trillion of capital) across private investment strategies.1 In 2022, although the absolute numbers were smaller compared to 2021, the number of new funds and the amount of capital raised were considerably higher than in any other year in history.2 In contrast, the past two and a half years have been more difficult for general partners (GPs) looking to raise capital. Fund managers have raised roughly 2,000 funds year-to-date, totaling $400 billion in capital, putting 2025 on pace to match 2024’s full-year numbers, which were lower than those from 2017 to 2020.3

The past few years have been difficult for many reasons, including a volatile interest rate environment, limited M&A, an IPO window that was essentially closed and, most recently, tariff uncertainty. As a result of these dynamics, many highly valued private companies that would have generated significant returns for investors elected to remain private, raise additional financing or reconsider their options to monetize the business. For limited partners (LPs) invested in funds that own stakes in these companies, exit timelines have been extended, and as a result, fund managers have returned only limited cash through distributions. This has caused some institutional investors to become over or fully invested across private investment strategies, resulting in minimal dollars available to redeploy in this market.

As a result of LPs being over or fully allocated, other alternative asset classes have been receiving attention, including hedge funds and cryptocurrencies. Hedge funds recently experienced their biggest inflows in a decade, and family offices and institutional investors are expressing interest in cryptocurrency investment strategies.4 Hedge funds saw inflows of $25 billion in the second quarter, the asset class’s most significant capital infusion since 2014, bringing first-half inflows to roughly $37 billion.5 A majority of this capital went to funds with $5 billion or more in assets, and multi-strategy funds continue to see inflows this year.6

Furthermore, LPs and GPs are wondering how long this dynamic will last. It appears the investment environment is starting to improve. During the first two quarters of 2025, there have been 109 IPOs, marking the strongest first-half performance since 2021.7 In addition to these IPOs, many investors sold portions of their stakes in order to crystallize distributions and send cash back to investors. While tariffs remain top of mind, and many negotiations between the U.S. and countries worldwide are ongoing, markets continue to perform well, and discussions around M&A globally appear to be improving.

Key Takeaway

The past few years have been difficult for private market fundraising due to a volatile interest rate environment, limited M&A and IPO activity, tariff uncertainty and lack of distributions to LPs. While it may take some time to materialize, it appears the investment environment is improving, and liquidity for private assets looks relatively positive. While fundraising activity has been sluggish in 2025, as fund managers send back distributions to LPs and reset allocations and budgets, we could see fundraising activity improve next year and see growth across total funds and overall capital raised compared to the past two and a half years.

Sources:

1-3Preqin

4-6Bloomberg – Private Asset Boom Cools as Hedge Funds, Crypto Nab New Billions; 8/4/25

7Ernst & Young – How Can You Shape Uncertainty Into Opportunity for Your IPO; 7/16/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.