Continuation Vehicles and Their Derivations Add Flexibility (And Complexity) in a Stagnant Exit Environment

August 21, 2025

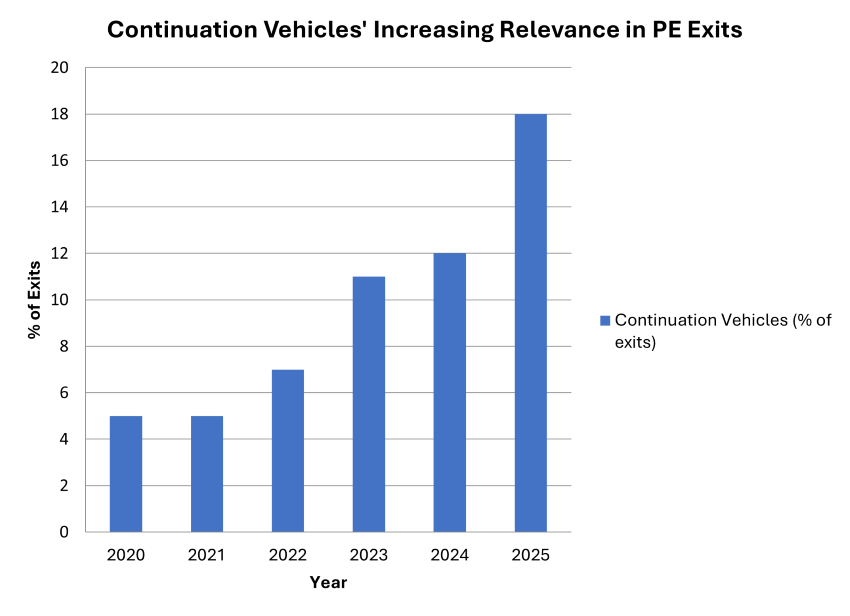

Private equity’s (PE) reliance on continuation vehicles has rapidly accelerated over the past several years amid exit market constraints, tight liquidity and investor appetite for more flexible solutions. Traditionally, general partners (GPs) relied on initial public offerings or mergers and acquisitions deals for portfolio exits – but recent market volatility, strained valuations and lower distributions compel firms to seek alternatives. Continuation vehicles (CVs) allow GPs to transfer assets from a maturing fund into a new, dedicated vehicle. This structure grants existing limited partners (LPs) the option to cash out – often at a discount to net asset value – or roll their stake into the new vehicle. In 2024 alone, U.S. and European PE exits to CVs jumped nearly 13% from 20231, representing a growing portion of overall exit activity and underscoring the sector’s pivot to these solutions as traditional exit routes have dried up.

The strategic advantage for GPs is clear: holding on to well-performing, familiar assets lets them unlock further value and sidestep unfavorable market conditions while resetting carry and management fees. For LPs, the flexibility to realize liquidity or continue exposure to mature assets is compelling, albeit with tradeoffs. Unlike traditional exits, LPs often face rapid decision-making windows with less transparency, and valuation practices may not always reflect current market reality. Regulatory scrutiny and standardized fee structures have started to mature in the market. Still, questions persist regarding the alignment of interests between GPs – who benefit from fee resets and prolonged management – and LPs, who seek optimal liquidity and risk management.

As CVs become mainstream, the market is witnessing the rise of “CV-squared” (CV²) deals – vehicles created from assets already held within a previous CV. In these scenarios, rather than finding a strategic buyer or public market exit, GPs initiate a second iteration, rolling assets repeatedly when liquidity or market conditions remain challenging. Some see CV² as innovation in portfolio management, allowing for longer asset holds and increased optionality, especially for cash-generating assets with steady earnings profiles. However, the move has drawn concerns over the potential for asset quality issues, increased concentration risk and further complexity for investors, as some assets may undergo multiple continuation rounds without clear exit resolution.

The ramp-up of those CV² deals (and discussion of possible CV³ structures) reflects PE’s adaptability and the structural challenges in today’s markets. The secondary capital universe supporting these transactions has grown dramatically – dedicated funds now bankroll ever-larger deals, bringing in lead investors with check sizes exceeding $200 million2. This evolution mirrors a world where traditional holding periods are less relevant, and private capital solutions potentially outcompete public exits. As more PE firms and top GPs embrace continuation and CV² deals, the practice has shifted toward permanent capital structures. GPs and LPs recycle assets through vehicles that allow investors to trade in and out with greater liquidity, albeit at the cost of added layers of fees and complexity for all parties involved.

Key Takeaway

PE’s reliance on CVs and their CV² descendants signals a transformation. What began as a tactical route to manage distressed assets or weather liquidity droughts is now a sophisticated, mainstream tool for portfolio management. For GPs, it delivers flexibility and fee opportunities; for LPs, it offers a menu of liquidity and yield choices. Yet, with more assets held across successive CVs and regulatory oversight catching up, the space demands greater transparency, robust valuation practices and ongoing attention to potential conflicts of interest. Continuation structures amplify both the risks and rewards of private equity, making informed decision-making all the more critical for stakeholders.

Sources:

1 NEPC – The New Mainstay in Private Market Deals: Continuation Vehicles; 02/27/2025

2 ION Analytics – CV-squared deals pile up as uncertain markets push GPs into longer holds; 05/08/2025

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.