Hedging Always Comes at a Price

September 4, 2025

On August 28, 2025, the S&P 500 Index closed above 6,500 for the first time, marking a gain of more than 30% from its April 2025 low.1 Despite the strong rally, investors are increasingly focused on preserving these gains and hedging against potential equity market pullbacks. Traditionally, put options were the go-to hedge. However, more recently, investors appear to be flocking to Chicago Board Options Exchange Volatility Index (VIX) futures as an alternative.

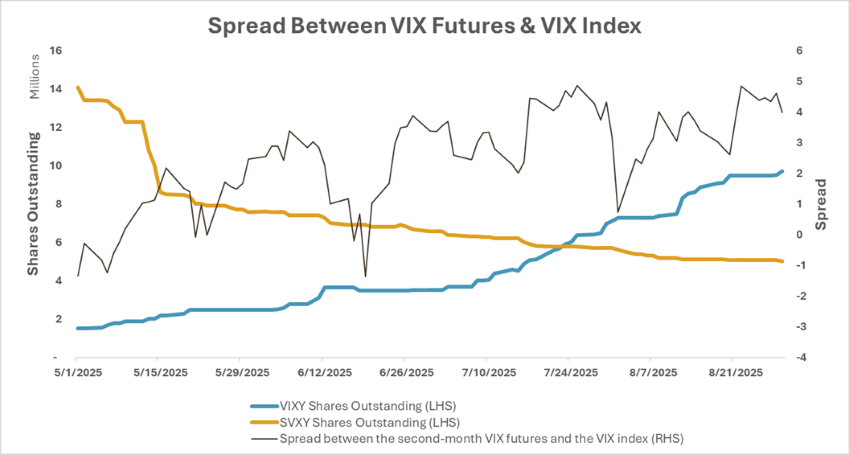

Long VIX futures exchange-traded funds (ETFs)/exchange-traded notes (ETNs) have surged in inflows. For instance, shares outstanding of the ProShares VIX Short-Term Futures ETF (VIXY) jumped from under two million in May to nearly 10 million as of August 29, 2025. The mechanism behind these products is straightforward: they gain exposure by holding long VIX future contracts, and their net asset value rises if equity volatility spikes. The key difference across the family of long VIX futures ETFs/ETNs is leverage, which can range from 0.5x to 2x.

When an investor buys a put option, the entire premium is lost if the market doesn’t decline. The longer the hedge period, the more costly the option premium becomes. By contrast, the appeal of using VIX exposure is that the index is perceived to have a “floor” at low levels. In today’s environment, this creates the impression that the downside risk of holding long VIX positions is limited, making the trade appear more attractive than traditional options.

The reality, however, is more nuanced. The catch lies in the premium of VIX futures over the VIX index. Since the VIX index is not tradable, futures are the nearest proxy. In today’s environment, VIX futures trade at a notable premium to the index. As futures approach maturity, they converge downward to the VIX index level, meaning long VIX futures positions inherently bleed value over time — even if the VIX index doesn’t move.

As today’s Chart of the Week highlights, this premium has widened as inflows pour into long VIX futures ETFs/ETNs. The spread between the second-month VIX futures and the VIX index has recently reached its widest level since early 2023.2 Conversely, ETFs/ETNs that short VIX futures — such as the ProShares Short VIX Short-Term Futures ETF (SVXY) — have seen significant outflows. This shift in flows tilts the supply-demand balance of VIX futures, embedding a rich risk premium into the contracts.

Key Takeaway

As investors search for more efficient ways to hedge their portfolios, long VIX futures have gained increasing traction. Compared to put options, the strategy may offer certain advantages, notably, stronger performance during sharp equity market pullbacks. However, investors must recognize the inherent costs in different hedging approaches. As demand for long VIX futures rises, so does the embedded risk premium investors pay. According to Bloomberg, hedge funds have been positioning on the opposite side of this trade to harvest the premium.3 In financial markets, there is no such thing as free hedging.

Sources:

1-3Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.