Nominal Spreads on Mortgage-Backed Securities Remain Wide Relative to Investment-Grade Corporates

September 11, 2025

The nominal spread for an agency mortgage-backed security (MBS) is the difference between the MBS yield and a Treasury security with a comparable maturity. It measures the extra yield the MBS earns over benchmark Treasuries, typically a blend of 5- and 10-year Treasuries. The nominal spread does not account for prepayment risk in the MBS, which can increase or decrease the weighted-average life (WAL) of the MBS.

Prepayment risk is the risk that the mortgage borrower will repay the principal amount on their mortgage earlier or later than expected. Prepayments increase as interest rates fall, as existing borrowers can refinance into lower mortgage rates. By the same logic, prepayments decrease as interest rates rise. This is also called extension risk. Prepayment options for home borrowers leads to MBS prices being capped on the upside and more sensitive on the downside, increasing the risk for investors in volatile interest rate environments. For MBS, the option-adjusted spread (OAS) incorporates the option cost arising from prepayment risk when calculating the expected return for investors.

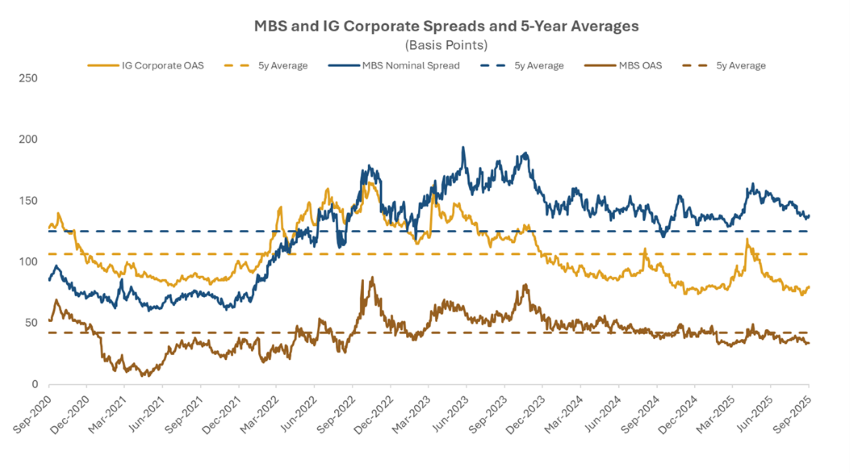

OAS for investment-grade (IG) corporates and MBS have retraced the widening that occurred in 2022 and 2023 during the Federal Reserve’s rate-hiking campaign to combat inflation. MBS OAS is currently in line with long-term averages, while IG corporate OAS is near all-time tights. Credit spreads in other sectors such as high-yield corporates, non-agency RMBS and asset-backed securities (ABS) are also trading near local tights. Meanwhile, MBS nominal spread remains wide, suggesting option costs embedded in MBS (which OAS captures) remain elevated.

Key Takeaway

Because many agency MBS are backed by government guarantees, investors are compensated for taking convexity risk rather than credit risk when investing in MBS. The wide nominal spread on MBS relative to OAS suggests convexity risks are high, indicating MBS prices will be especially sensitive to any interest rate changes. Finding effective strategies to mitigate convexity risk is a way to produce attractive returns in this environment.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.