Not Your Parents’ High-Yield Market

September 18, 2025

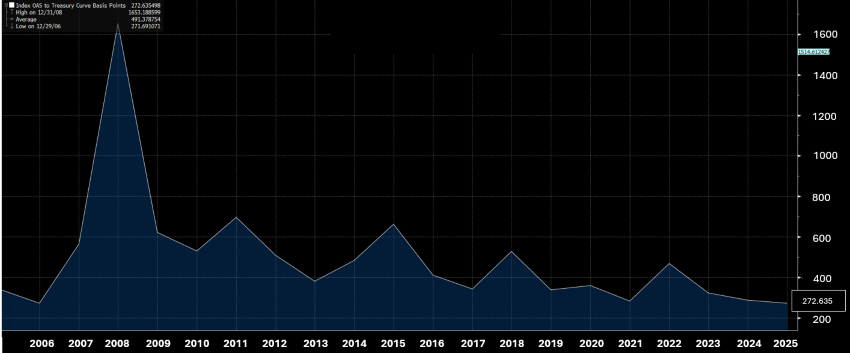

As of Sept. 16, 2025, the Bloomberg U.S. Corporate High Yield Bond Index offered approximately 270 basis points of additional spread over the U.S. Treasury, among the tightest levels over the past two decades. Today’s spread hovers near the lows experienced before the Great Recession and in 2021, after COVID-19. These similarities may lead one to surmise that the market is on the precipice of a pullback. This may be the case; however, other factors are in play that justify the current trading levels. I would submit that this is not your parents’ high-yield market.

This is a much healthier high-yield index than in the past. According to Bloomberg, as of Sept. 12, 2025, 51% of issuers in the index were rated BB.1 In September 2007, just before the Great Financial Crisis, the percentage of issuers with BB ratings sat shy of 35%.2 The improvement in credit quality has gained momentum over the past half a dozen years, with the percentage of high-yield issuers carrying BB ratings crossing the 40% mark in 2018.3 By September 2019, it had reached 44%; by September 2022, it was 49%.4 There are several factors that account for the higher quality of the index.

As I noted in my previous Chart of the Week, an increasing number of high-yield participants have been issuing secured debt versus unsecured debt. In addition, strength in the underlying economy has resulted in improved credit statistics for index constituents while also allowing companies greater access to capital markets to refinance balance sheets, largely eliminating liquidity concerns. Perhaps the largest factor contributing to the improved quality of the high-yield bond market is the outsized growth of the broadly syndicated loan and private credit markets. According to Bloomberg, the broadly syndicated leveraged loan market is currently $1.4 trillion in market value, up from $1.1 trillion just prior to COVID-19.5 According to the Federal Reserve Bank of Boston, private credit had reached approximately $1 trillion by the end of 2023.6 The growth of these markets has provided additional financing outlets for some of the more speculative players in the leveraged credit arena. This growth has reshaped the high-yield market, historically the dominant provider of funds to speculative credits. As the leveraged loan market expands, it has attracted some of the more aggressive capital structures that likely would have otherwise looked to access high-yield bonds. In contrast to the high-yield bond market, only 21% of issuers in the leveraged loan market are rated BB.7 It is likely that the infamous RJR Nabisco acquisition that was funded by high-yield bonds in the late 1980s would, today, access the loan market for a substantial portion of its financing needs.

Key Takeaway

With the evolving landscape in the leveraged credit space, the high-yield market is healthier today than it has been in the past two decades. On a risk-adjusted basis, we may not be trading too tight and may, in fact, have room to tighten further.

Sources:

1-5,7Bloomberg

6Federal Reserve Bank of Boston – Could the Growth of Private Credit Pose a Risk to Financial System Stability? 5/21/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.