Long Credit Spreads Are Tight

October 2, 2025

If you turn on a financial news show, or read commentary on various markets, you will probably see a story about lofty valuations. Equity indices are at, or have recently set, record highs. Gold has surged 46% year-to-date and trades near its recently set record,1 with silver also close to its all-time high.2 Credit markets have mirrored the trend, setting new highs.

Investment-grade (IG) corporate credit valuations, by many measures, are extremely full. The option-adjusted spread (OAS) recently reached its tightest levels since the late 1990s.3 Aside from the tight nominal level, the spread per unit of duration is also at tight levels, sitting in the top three percentile since 2000.4 These levels are all the more impressive given the last time spreads were this tight, the Bloomberg U.S. Corporate Index was of much higher quality. In the late 1990s, the index was 27% BBB, whereas it is now almost 46%.5

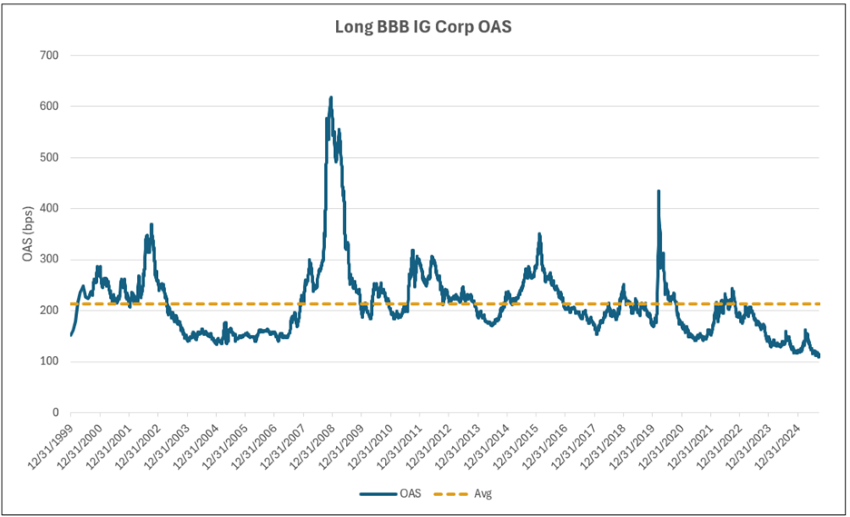

Today’s Chart of the Week focuses on a subset of IG corporates, specifically long BBB-rated bonds. The bid for duration generally has been quite strong as of late, driven by BBB credit. Since 2000, long BBB spreads are at the tights and almost 100 basis points (bps) through the average for the period.6 After years of low interest rates, some may attribute the rise in rates as a contributing factor to this spread move. However, long corporate credit yields are not far from the historical average.7 This spread move is driven more by the shape of the long-end of the Treasury curve. The 10-year/30-year Treasury curve was much flatter and, at some points, inverted just a few years ago.8 As the Treasury curve has steepened (recently hitting 70 bps),9 credit curves have flattened significantly.

While total IG issuance has been heavy, with September printing the second-highest monthly volume ever (excluding the three spring months of 2020 at the peak of COVID-19 supply), long-end supply has been relatively light.10 Long BBB bonds now account for only 14% of the index, down from a peak of 21% in 2021.11 This technical is likely contributing to the depth of the long-end bid.

Key Takeaway

In the IG corporate market, some of the tightest valuations are in long BBB-rated paper. After years of a flat long end of the Treasury curve, the current steepness has been a primary driver of the bid for long-end corporate bonds. The record September issuance has caused spreads to back up off the tights slightly. However, with expectations of negative net IG supply post-coupon payments for the remainder of the year,12 investor demand will likely be poised to keep IG spreads firm.

Sources:

1-11Bloomberg; as of 10/2/25

12Barclays Credit Research; 9/26/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.