Is Monetary Easing Driving Renewed Private Markets Deal Flow—or Inflating Expectations?

November 6, 2025

Source: PitchBook Data, Inc.; Federal Reserve Bank of New York

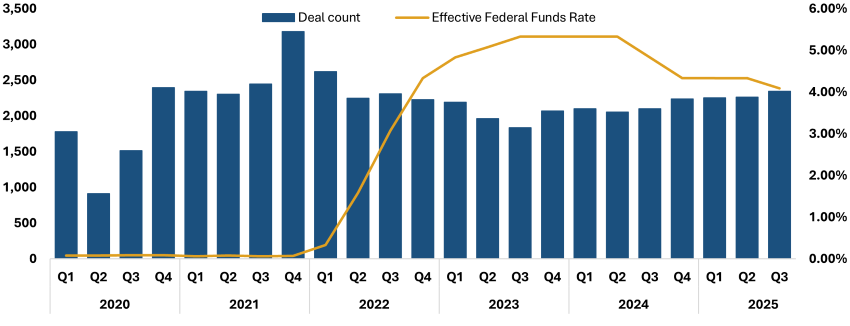

As central banks pivot toward rate cuts after nearly three years of tightening, private markets are wrestling with a key question: Is monetary easing truly reigniting deal activity, or simply inflating expectations in a market still adjusting to structurally higher capital costs?

For private equity and venture capital funds, which spent much of the past year focused on portfolio triage and stabilization, the return of liquidity presents a welcome incentive to deploy idle dry powder. Yet the data paints a nuanced picture. Deal flow has shown modest signs of recovery, not a full resurgence. While some sectors are seeing renewed interest, the overall pace remains measured.

General partners (GPs) continue to tread cautiously. Few are willing to underwrite growth at valuations reminiscent of 2021’s exuberance, and underwriting standards remain tight. Even amid easier financial conditions, lenders remain selective and equity checks have been disciplined. The prevailing sentiment is that deal volume will rise in pockets—particularly in sectors with earnings resilience and structural tailwinds, such as artificial intelligence, cybersecurity and life sciences—rather than across the board.

The psychological effects of monetary easing may also be outpacing its practical impact. Valuation expectations are creeping higher, especially in early-stage venture rounds and mid-market buyouts, suggesting that some investors may be extrapolating the short-term rate relief. Limited partners (LPs), meanwhile, are increasingly wary of optimistic marks that depend on future growth acceleration rather than near-term cash flow realization.

For private credit managers, the narrative is even more complex. Lower base rates reduce their yield advantage, potentially compressing returns. At the same time, they unlock refinancing opportunities that can stabilize portfolio companies and extend runway. This rebalancing presents both headwinds and opportunities: while spreads may narrow, deal activity could expand into sectors previously under stress, such as consumer discretionary and industrials.

The interplay between private credit and equity capital is becoming increasingly central to understanding whether the capital cycle is genuinely restarting—or simply rotating within constrained boundaries. Cross-asset collaboration, particularly in structured equity and hybrid financing, is likely to increase as managers seek innovative ways to deploy capital in a cautious yet opportunity-driven environment.

Key Takeaway

As year-end approaches, optimism must be tempered by structural realities: elevated baseline inflation, persistent geopolitical tensions and investor fatigue from delayed exits. Monetary easing can lubricate financial systems, but it is unlikely to fuel a broad-based resurgence in private markets deal flow on its own. The coming quarters will be critical in determining whether current momentum is sustainable—or merely a fleeting response to liquidity relief. In many ways, 2025 may not mark a return to past exuberance, but rather a recalibration—easier money meeting a more disciplined, fundamentals-driven market.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.