From Headwinds to High-Water Marks: CMBS Resilience Delivers Banner 2025

January 15, 2026

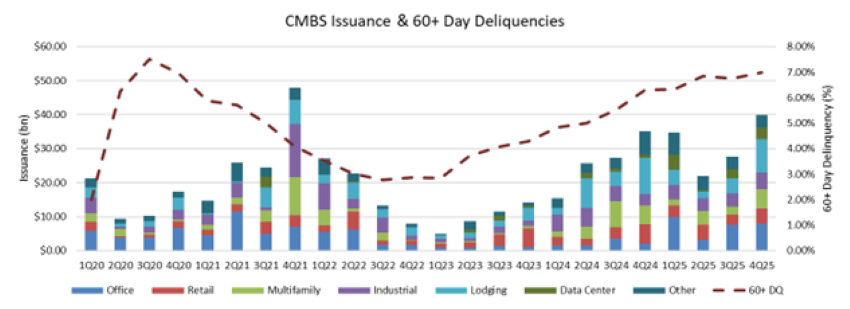

2025 saw a post-Great Financial Crisis record of commercial mortgage-backed securities (CMBS) issuance at nearly $125 billion across multi-borrower conduit and single asset, single borrower (SASB) products, 20% higher than 2024 and over 10% higher than the previous high-water mark set in 2021.1 Office and data center were notable outperformers, each increasing by over 200% from 2024 levels.2 SASB assets continued to dominate the new-issue market with almost 75% of the year’s contribution in volume,3 while conduit deals with a 5-year term accounted for 70% of the remaining issuance.4 Although the new-issue market delivered record-breaking results, a steady uptick in CMBS delinquencies underscores the need for vigilance in asset selection while emphasizing the resilience of the CMBS market.

Today’s Chart of the Week highlights that current 60+ day delinquencies—defined as CMBS loans two or more months past due—are approaching the previous peak reached in mid-to-late 2020, when the commercial real estate (CRE) market was digesting immediate pandemic-related shocks.5 In December 2025, delinquencies of 60 days or more stood at 7% across all property types.6 Office loans lead the way in delinquency, as Class B/C assets have experienced slower recoveries than highly amenitized Class A offices. More than 11% of all office assets outstanding have missed at least one payment in the last 12 months.7 Looser underwriting standards, inflationary expenses and increased borrowing costs, driven by a higher interest rate environment, have pressured profit margins and made end-of-term refinancing decisions more challenging for sponsors and lenders.

Despite these headwinds, the CMBS market continues to forge ahead, achieving new issuance records. Enhanced structure and conservative underwriting, along with incentive alignment (such as significant cash-in refinances), help the market endure through both credit-related (ex, office distress) and macroeconomic-related (ex, elevated rate environment) cycles. Evolving products, such as the rising popularity for 5-year term conduit loans, which were rare before 2023, enable structured-product investors to continue deploying capital in the CMBS market while providing borrowers with creative financing solutions. Emerging asset classes like data centers also serve a similar purpose, driving diversity in investment portfolios and expanded opportunities for property owners. As the new-issue market continues to evolve, enhanced diligence remains essential. Surveillance of existing loans should inform and encourage dialogue among the investing community, issuers and sponsors to continue to foster a healthy market for all participants.

Key Takeaway

Although some fundamental distress continues to work its way through the CRE system and investor portfolios, the evolution and adaptation of the CMBS market continues to be a defining feature of this structured product asset class. Through open and constructive dialogue around structure, underwriting and incentive alignment, all stakeholders can find meaningful solutions to thrive through market cycles. Thorough due diligence, thoughtful risk awareness and careful surveillance remain crucial to a sound investment process, allowing the CMBS market to continue reaching new heights.

Sources:

1-3,5-7Trepp

4DB Research

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.