CMBS Goes Short: Why 5-Year Loans are Taking Over

October 16, 2025

For decades, the commercial mortgage-backed securities (CMBS) market has been anchored by the 10-year fixed-rate conduit loan — a structure designed to provide predictable cash flows, strong call protection and a close resemblance to corporate bonds. These long-term, locked-out loans appealed to investors — especially insurance companies seeking assets that matched long-dated liabilities — and offered borrowers stable, attractive rates in exchange for limited prepayment flexibility.

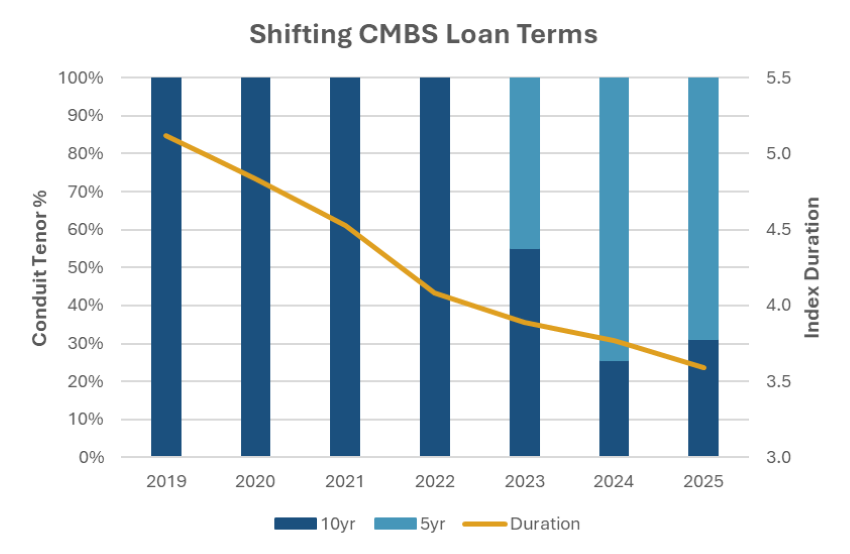

Today, however, a meaningful shift is underway. In the wake of heightened interest rate volatility, macroeconomic uncertainty and shifting real estate fundamentals, the CMBS market has seen a notable migration toward shorter loan terms — particularly 5-year loans. As shown in today’s Chart of the Week, in 2019, 100% of fixed-rate conduit deals were issued as traditional 10-year structures. By 2025, however, only 31% of new issue CMBS conduit deals are backed by 10-year loans, while 5-year loans comprise nearly 69%. This shift from 10-year to 5-year loans is more than a technical change; it signals a fundamental shift in how borrowers, lenders and investors assess risk, opportunity and flexibility in the current environment. As a result, the average duration of the Bloomberg Non-Agency CMBS Investment Grade Index has dropped from 5.1 years at the end of 2019 to only 3.6 years today.

Elevated interest rates and the uncertainty surrounding their trajectory have driven borrowers to be more reluctant to lock into long-dated debt. Shorter-term loans reduce long-term exposure to potential declines in property values, shifts in income projections and volatility in occupancy rates. In today's market, underwriting a 10-year loan requires greater confidence in a stable operating environment — something that is increasingly challenging to achieve amid rising capitalization rates, inflationary pressures and uncertainties surrounding property valuations.

A shorter 5-year term limits exposure to the risk of being stuck with a high coupon if rates fall. It also gives borrowers more optionality — the ability to refinance sooner if economic or market conditions improve. From the investor’s perspective, shorter-term bonds reduce both credit and interest rate risk. They enable more frequent repricing, better alignment with uncertain property cash flows and lower exposure to structural shifts in commercial real estate (CRE), such as evolving work-from-home trends or disruptions in the retail sector. However, duration-sensitive investors may face challenges aligning portfolios with traditional benchmarks. As issuance shifts toward 5-year loans, the average duration of investable CMBS products declines, creating a duration shortfall for active managers trying to match or outperform their benchmarks.

The shift toward shorter-term loans is not without consequence. A growing share of 5-year loans indicates more refinancing activity concentrated in the near term (e.g., 2029–2030 rather than 2034–2035), effectively pulling forward credit risk. If interest rates remain elevated or property values do not recover, the risk of refinancing difficulties may increase, potentially triggering broader impacts throughout the commercial real estate financing environment. Furthermore, the scarcity of 10-year paper has left investors seeking duration with fewer options. As a result, insurers and other long-term investors may need to look elsewhere or adjust their portfolios — possibly affecting pricing, liquidity and capital allocation across fixed-income markets.

Key Takeaway

The dominance of 10-year CMBS loans is no longer standard. What began as a cautious response to interest rate risk and market volatility has evolved into a broader market recalibration. Borrowers now prioritize flexibility and adaptability over long-term certainty. Some investors are seeking shorter, more manageable exposures in a market with shifting fundamentals. However, active management may be more challenged, especially for yield and duration targeting.

Ultimately, the rise of 5-year CMBS loans reflects current risk tolerance — and a signal that confidence in long-term property cash flows, valuations and economic stability remains uncertain. As the market continues to evolve, it is crucial for participants across the capital stack to remain nimble, striking a balance between flexibility and discipline in an increasingly diverse landscape.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.