As High-Yield Market Shrinks, Strong Fundamental Credit Stories Become Even More Important

April 27, 2023

Every week, the markets get updated with the Lipper fund flows for the U.S. high-yield asset class. Year-to-date, those flows have been materially negative, but in the past four weeks, we’ve seen over $8 billion of new money pour into the asset class (per JPM research). These fund flows are important to gauge market sentiment and can indicate which direction the market may be moving (at least in the short term).

The primary market and new issuance supply are also critical parts of the equation. In addition to the primary market, the total amount of bonds outstanding in the Bloomberg U.S. Corporate High Yield Index can be impacted by rising stars and fallen angels (companies moving into and out of the investment-grade market, respectively), as well as defaults. Combining all of these elements can illustrate the supply/demand balance or imbalance for the high-yield asset class.

The increased demand recently has coincided with a strong month for U.S. high-yield investors, with the Bloomberg U.S. Corporate High Yield Index up approximately 0.69% so far in April. That monthly return to date also reflects a strong 2023 to this point, with year-to-date returns up 4.28%.

Additionally, the money flowing into high yield looks very similar to the flows we were seeing in early November. Those flows also came at a time of light new issuance and when the high yield total market size had already shrunk. With fewer bonds to buy and more demand, the high-yield market had a strong rally to close out 2022.

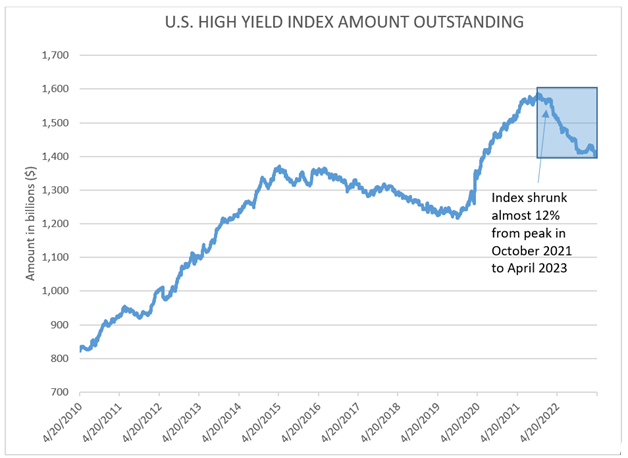

The size of the U.S. high-yield market can be very influential. As seen in this week’s chart, the market has been shrinking in terms of the dollar amount of bonds in the index. By that measure, it is down almost 12% since its peak in October 2021. Over that time, the market has had some periods of strong returns as well as some weak periods.

Per the JPM Sales and Trading Department, year-to-date there has been over $38 billion of rising stars and only $14 billion of fallen angels. In 2022, there was $113 billion of rising stars versus only approximately $13.6 billion of fallen angels. These upgrades and downgrades have contributed to the smaller market size illustrated in this week’s chart.

Also, the strength in the high-yield market can be explained at least in part due to the smaller market size, lack of new issuance and the recent strong fund flows. However, there is clearly more to the story than just the supply and demand of bonds.

Key Takeaway

There are many drivers of total return for the high-yield asset class. The technical picture certainly has an impact and particularly in the near term. As the high-yield market continues to shrink from rising stars leaving the index, it becomes even more important to invest in strong fundamental credit stories.

The fundamentals will differentiate fund performance over the long run and that is what I constantly strive to do. I will continue to monitor all aspects of the high-yield asset class, but when it comes time to invest in a company and a bond, having a thesis and conducting strong fundamental analysis are paramount.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.