Clouds Looming on the Horizon for Commercial Real Estate

June 1, 2023

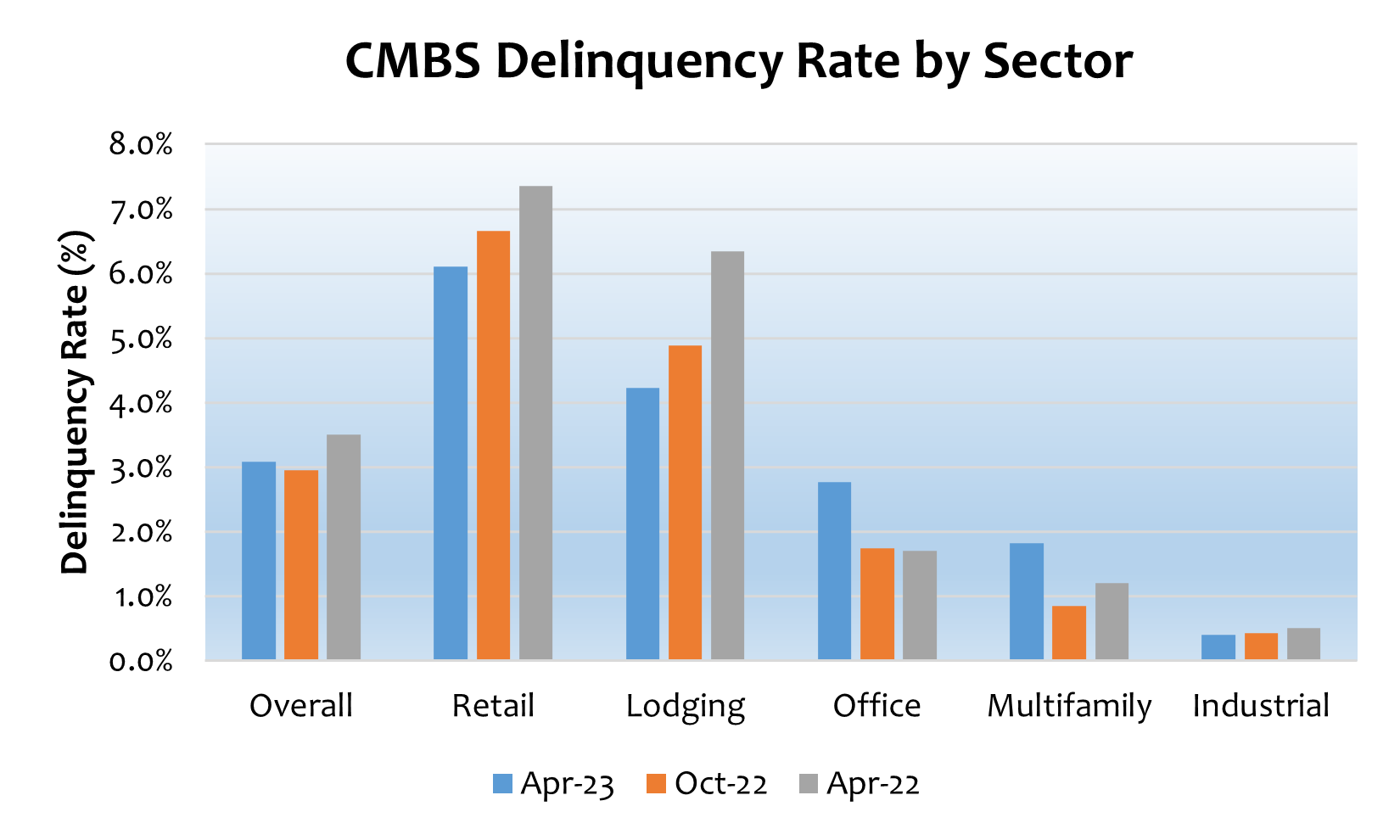

Today’s Chart of the Week highlights changes in the delinquency rate by property type in the commercial mortgage-backed securities (CMBS) market over the past year. Despite increasing market volatility since the beginning of 2023, delinquency rates remain at the low end of their historical range across all property types.

The overall delinquency rate remained unchanged in April at 3.09% and is down 42 basis points (bps) from one year earlier. Retail, lodging and industrial properties have also experienced year-over-year declines in their delinquency rates. However, office (the most-watched sector within CMBS) has experienced an increase of 106 bps year-over-year.

The office sector continues to be tested amid anemic rent growth and rising vacancies. The office market is facing a secular shift in remote work, which has resulted in lower physical presence at office buildings. Many firms are reevaluating their usage of office space, with some looking to downsize. Sublease space is at or near record-highs in many markets as demand has waned.

Office leases tend to be long term, but as they expire over time, building owners may face a tougher time retaining tenants. The future of office space may change given the persistence of hybrid work. Many questions remain about how this sector will perform over the coming years.

Recent market volatility and turmoil in the banking sector have also raised some concerns among commercial real estate investors. Although the overall delinquency rate remains relatively benign, watchlisted and specially serviced loans are on the rise. Unlike the loss rates we experienced for loans issued prior to the financial crisis, loans underwritten in recent years have generally been much more conservative.

The weighted average loss rate for 2005 to 2008 transactions was 9.7%, which was driven by high leverage and aggressive underwriting. Since then, structural protections have been put in place for CMBS, including higher required subordination levels per rating class. Cumulative losses for post-2009 vintages are historically low so far, averaging 1.8% for 2010 to 2012 vintages.1

Each major property type is facing some common and unique challenges due to growing macroeconomic headwinds. Property valuations are beginning to fall, rent growth is declining and an uptick in vacancies, along with rising expenses, will contribute to a decline in net cash flow to the properties. Oversupply in certain markets will put pressure on valuations. Older, outdated properties may struggle to perform, while newer properties in sought-after markets should outperform.

Key Takeaway

On the positive front, overall delinquency levels remain below long-term averages despite elevated levels of watchlist loans. Unlike the great financial crisis of 2007-08, recent loan underwriting remains disciplined and may help limit defaults and losses. The majority of CMBS securitizations were able to weather the storm, as special servicers worked with the borrowers to restructure their debt. Most of the risks within CMBS transactions are borne by investors who own the equity or lower-rated tranches within the deal.

Challenging times may be ahead, as CMBS loans reach their maturity dates and could struggle to refinance amid higher funding costs and tighter lending standards. Higher interest rates have caused debt-service coverage ratios and loan-to-value ratios to decline, hindering refinance success. I expect commercial real estate property prices to decline across most property types for the remainder of the year. I continue to maintain an up-in-quality bias as clouds are looming on the horizon.

Source:

1Citi Research – CMBS Weekly: Office Loans at Banks and Insurers; 5/12/2023

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.