Santa Came Early This Year for IG Corporate Investors

December 21, 2023

Investors have weathered some notable events this year. The banking crisis in March saw three small- to mid-sized U.S. banks fail amid the Federal Reserve’s (Fed) rapid increase in rates and the duration mismatch at the banks. Regulators acted quickly with extraordinary measures to ensure all deposits would be honored, and the Fed established the Bank Term Funding Program (BTFP) to provide loans to banks pledging qualifying collateral. This was followed by Swiss bank regulators arranging for the UBS acquisition of Credit Suisse Group following a crisis of confidence and liquidity.

Fed rate increases continued after these events, with the last increase occurring in July. Meanwhile, the nation’s ongoing significant deficits have been financed in this higher rate environment, and many are sounding alarm bells (not jingle bells) as the national debt grows.

Following peak rates in October, inflation data continued to show steady signs of cooling. The 10-year Treasury yield had fallen sharply in anticipation of the Fed moving up the timeline of rate cuts. After last week’s Federal Open Market Committee (FOMC) meeting, the dot plot shows the federal funds target rate 50 basis points (bps) lower than the September meeting with a rather dovish Chair Jerome Powell seemingly calling a peak in rates and in the midst of a pivot. The 10-year is now more than 100 bps off the highs set on October 19. As of last Friday, the futures market shows 2024 ending with a federal funds rate of 3.91%, still well ahead of the FOMC.

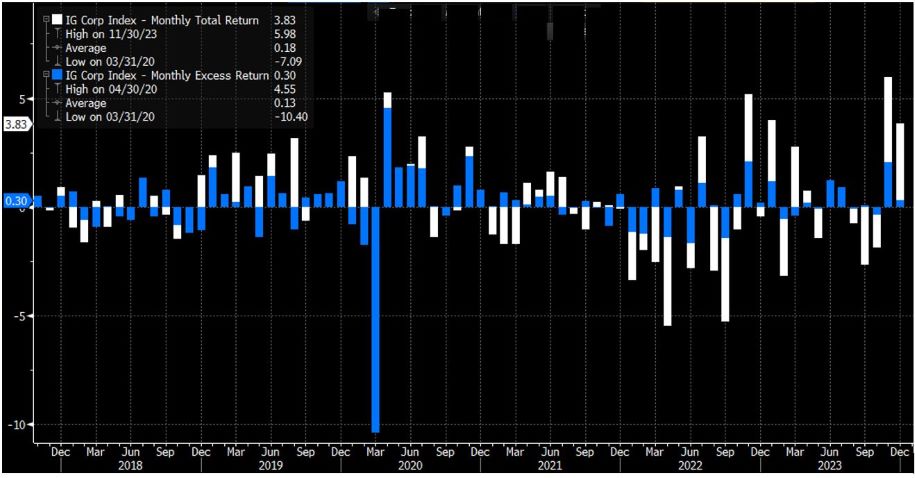

Over the past couple of months, virtually all risk assets have performed extraordinarily well. Investment-grade (IG) corporate credit investors, as noted in today’s chart of historical monthly returns, have experienced extremely strong excess and total returns. In fact, November was one of the strongest months of total returns — ever. Only one other month, December 2008, has experienced stronger total returns since the mid-1980s — an early Christmas gift for IG corporate investors. Excess returns were similarly strong, posting the sixth-strongest monthly excess returns since 2010.

Key Takeaway

Last week’s FOMC meeting and press conference provided continued strong momentum from November’s historical results. The corporate index total return from the end of October through last Friday was up over 10%. The option-adjusted spread (OAS) is slightly off the tightest levels of the year set last week at 99 bps. Spreads are tight, and as I have written about previously, average 12-month forward excess returns historically are disappointing when the index OAS is inside 120. Admittedly, yields appear somewhat attractive even after the recent move. The corporate index average yield since 2000 is 4.33%, while it currently sits at 5.15%. However, the velocity and extent of the recent performance appear as if some of 2024 performance may have been pulled forward with a soft landing largely priced in. I anticipate that further total returns will be largely a function of rates with excess returns harder to come by.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.