Optimism for Aggressive Rate Cuts Fades

February 22, 2024

In the previous week, a whirlwind of market news swiftly captured the attention of investors, undoubtedly prompting scrutiny from the Federal Reserve (Fed). From the consumer price index (CPI) year-over-year (YoY) spiking to 3.1% (beating estimates) and a solid month-over-month (MoM) increase of 0.3%,1 to jobless claims staying below historical averages as well as upbeat producer price index (PPI) and manufacturing sentiment, signs point to a robust consumer and labor market.

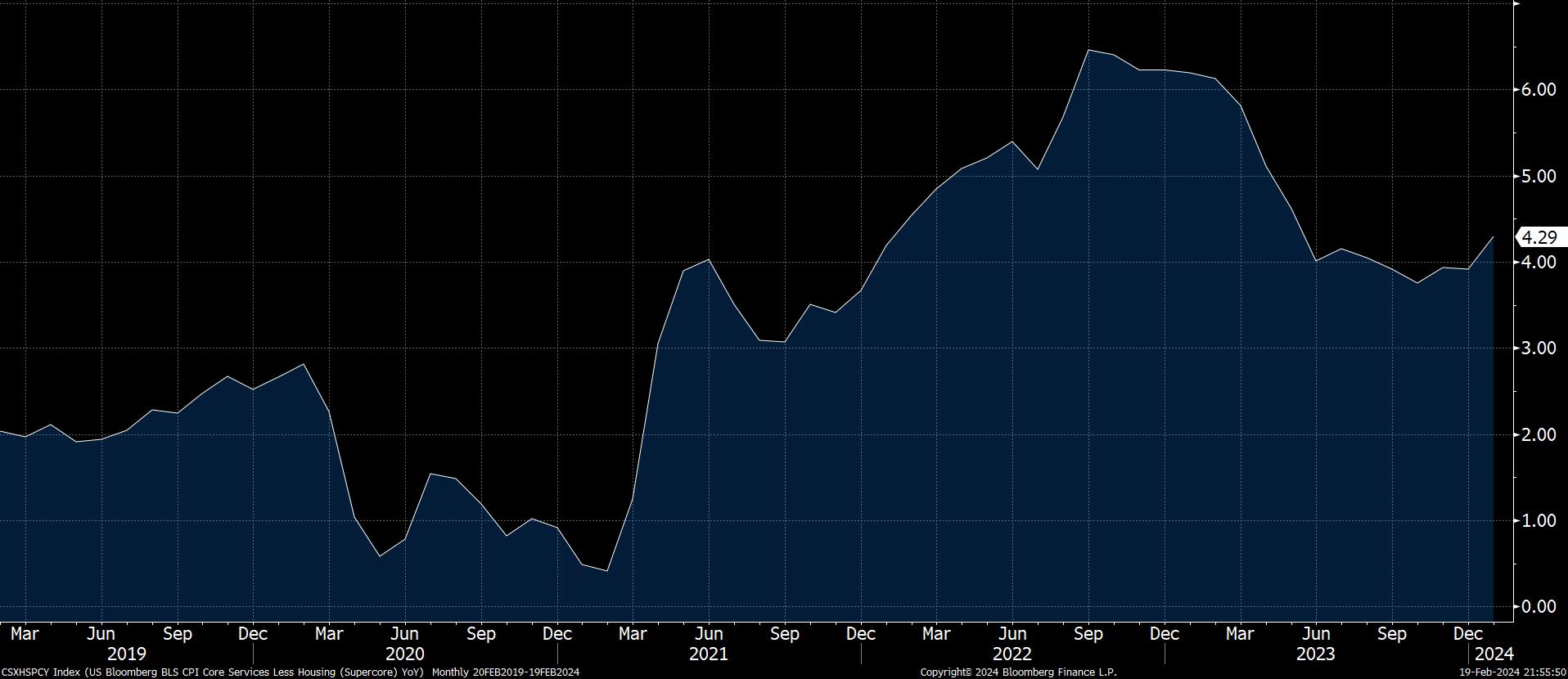

Looking closer at the CPI report, energy — a volatile sector often left out of other inflation measures — took a dive with -4.6% YoY.2 So, let's zoom in on the U.S. Bloomberg BLS CPI Core Services Less Housing, also known as supercore inflation. This index tends to be a measure of the stickiness of inflation as it focuses specifically on the prices of services excluding housing-related expenses. This includes services such as healthcare, transportation, entertainment, etc.

In analyzing today’s Chart of the Week, it becomes apparent that service inflation has been on the rise, effectively countering deflationary pressures observed in goods. This resilience suggests that consumers may not be significantly impacted by the prospect of a tighter monetary policy and are displaying signs of strength.

Toward the end of 2023, there was a growing expectation that the Fed would begin easing its policy rate this year. However, market sentiment has shifted since then. At the close of 2023, markets were pricing in the first full rate cut by March 20 and a total of 6.3 cuts for the year.3 Now (as of 2/19/24), the market has adjusted its expectations, pricing in the first full rate cut by June of this year and a total of 3.6 cuts for 2024.4 Interestingly, as these expectations have shifted, we've seen the market price out cuts while the S&P 500 Index has soared to all-time highs.

Considering the Fed's statutory goal, as outlined in the Federal Reserve Act, which aims to promote maximum employment, stable prices and moderate long-term interest rates, one might question whether current economic conditions warrant a reassessment of the neutral rate. Employment remains robust, and while prices are higher, they appear to be stabilizing. Could this signal a potential shift toward a higher neutral rate in the future?

Key Takeaway

As we navigate the intricate market narrative, it's becoming increasingly evident that earlier projections of aggressive rate cuts by the Fed might just be too optimistic. With expectations of fewer cuts and the S&P 500 Index reaching new heights, there remain risks associated with the Fed cutting rates prematurely. Inflation has shown signs of resilience and could potentially surge again if monetary policy is relaxed too soon.

Sources:

1,2U.S. Bureau of Labor Statistics – Consumer Price Index Summary; February 2024

3,4Bloomberg

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.