Maxed Out?

May 16, 2024

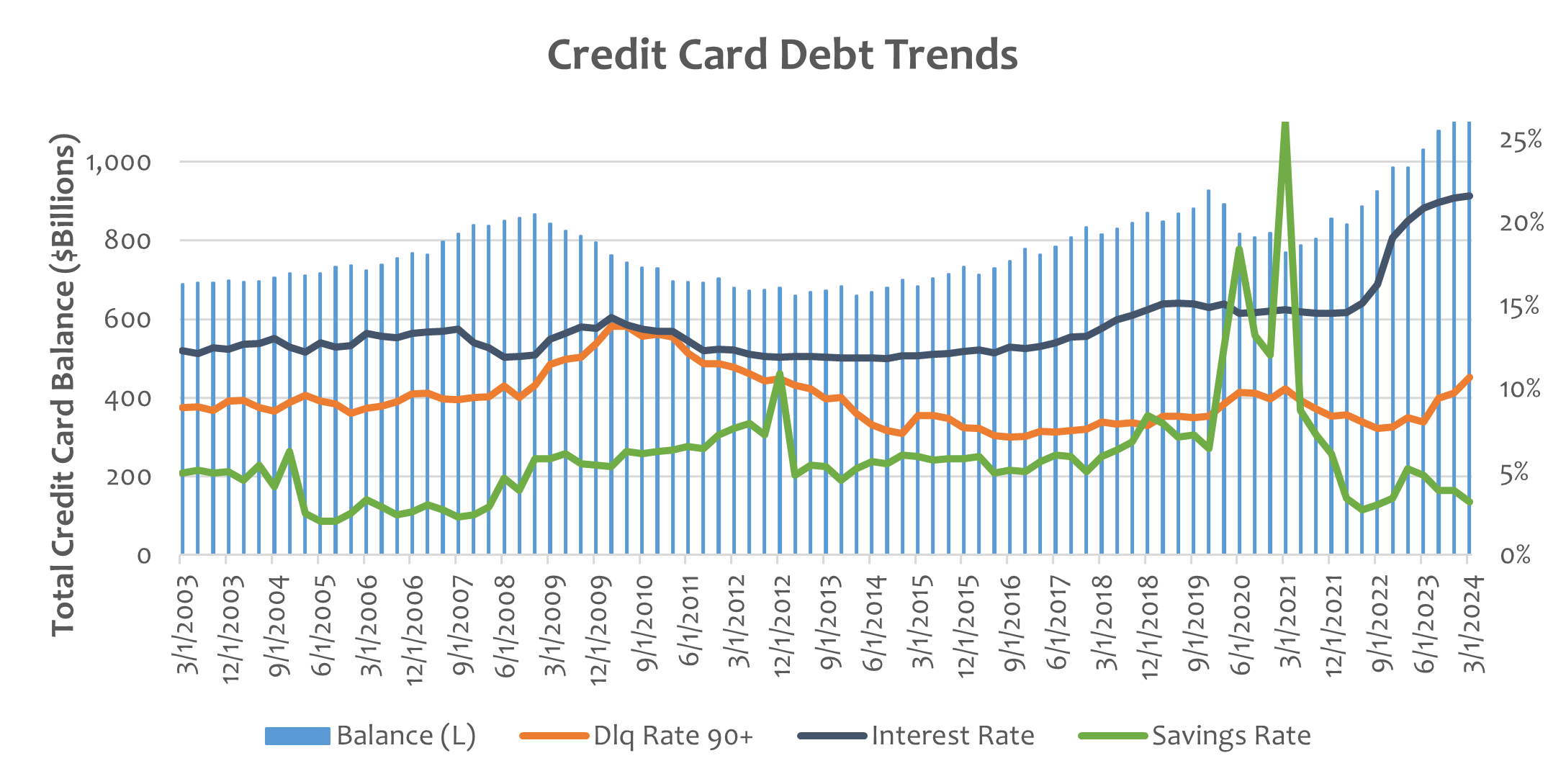

The U.S. consumer entered 2024 in stronger-than-expected financial health, however, some headwinds remain. Higher interest rates and lingering inflation continue to put strain on consumers. Inflation hit a 40-year high of 9.1% in June 2022, falling to 3.4% in the April 2024 reading, which remains above the Federal Reserve’s (Fed) target of 2%.1 At the beginning of the pandemic, consumers improved their financial balance sheets as we saw a remarkable rise in the personal savings rate, and consumers drastically reduced their spending. Over the course of the past few years, this has reversed course as consumers have exhausted much of their savings. The current personal savings rate of 3.9% has fallen below pre-pandemic levels.

Consumer credit performance has held up well but is beginning to show some weakness in credit cards. As costs for everyday items have increased over the past few years, some consumers are using credit card debt to fund purchases. Total outstanding credit card debt rose to $1.1 trillion as of the first quarter of 2024, a 13.1% increase year-over-year and a 32.6% increase from the first quarter of 2022. Credit card debt has increased the most over the past two years, more than any other category of consumer loans.2 Credit card debt represents 6.3% of total household debt, up from 5.8% in the first quarter of 2023.3

As the outstanding balances on credit cards have risen, the interest charged on those balances has risen as well. Most consumer loan rates, including credit card annual percentage rates (APRs), have been rising and are closely correlated with the federal funds rate. Elevated interest rates have made consumer debt more expensive. Credit card interest rates have spiked to 21.6% as of March 2024, a 47.9% increase from two years earlier, the highest rate dating back to 1994.4

Since the end of pandemic-related fiscal stimulus, some consumers have had a more difficult time keeping up with rising expenses. Credit card debt is becoming more expensive, and lower-income consumers may be relying on revolving debt to fund purchases. Serious delinquency rates are beginning to rise while savings rates are falling. Serious delinquency rates, defined by an outstanding balance when it becomes 90 or more days overdue, rose to 10.7% as of March 2024 compared to 8.2% one year prior — a 30.5% year-over-year increase.5

Key Takeaway

With higher for longer Fed policy returning, I expect to see even higher credit card balances and loan rates as consumers continue to spend despite inflation. While household leverage has risen, most American households are still able to manage their debt burden as their asset values driven by homeownership are outpacing liabilities. However, younger borrowers may be struggling to repay their debt. Consumer spending is likely to be more selective, returning to historical averages. Risks to further credit weakness could rise if the unemployment rate increases combined with higher interest charged on credit card balances. Lower-income cardholders would feel the greatest financial strain.

Sources:

1Reuters – US consumer prices rise less than expected in April; core CPI slows; 5/15/24

2,3,5Federal Reserve Bank of New York – Quarterly Report on Household Debt and Credit; May 2024

4Federal Reserve Bank of St. Louis – Federal Reserve Economic Data; May 2024

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.