U.S. Insurance Increasingly Turns to Whole Loans for Residential Mortgage Credit Exposure

June 12, 2025

Insurance capital has long played a part in residential mortgage credit. Still, it has become an even larger player more recently as banks have pulled back amidst stricter capital requirements and competition from non-bank lenders. Although most U.S. residential mortgages become securitized in agency residential mortgage-backed securities (RMBS), which carry an explicit or implicit government guarantee, the portion that is not agency-guaranteed finds its way into the non-agency RMBS and residential whole loan (RWL) markets and provide investors with exposure to mortgage credit. Non-agency RMBS — also referred to as private-label securities (PLS) — are securities backed by pools of non-guaranteed residential mortgages that are structured and rated, with the various tranches in a securitization offering investors varying levels of risk and return based on their position in the deal structure. Residential whole loans differ from PLS in that the investor owns the mortgages outright, providing full exposure to the mortgages’ cashflows.

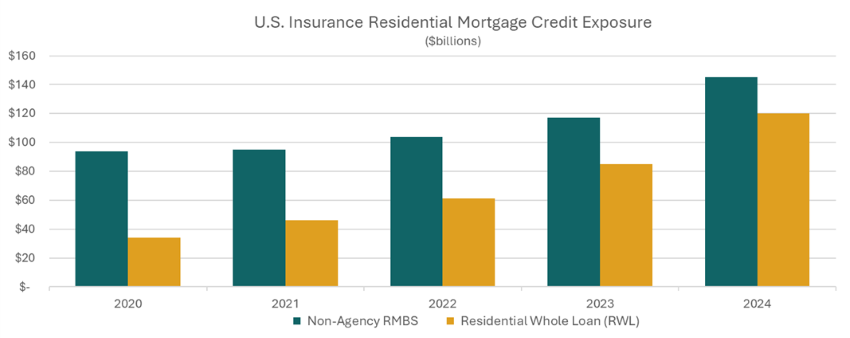

Today’s Chart of the Week highlights that as insurance company demand for mortgage credit continues to rise, insurers are increasing their exposure to whole loans relative to non-agency RMBS. Despite the same underlying fundamentals, differences between non-agency RMBS and RWLs could explain this trend.

The U.S. housing market has continued to display strong underlying fundamentals in recent years, driven by a structural undersupply of housing. For insurance companies looking to increase expected returns to support their products, taking on mortgage credit risk has been an attractive diversifier away from traditional corporate credit. However, a typical non-agency RMBS securitization issues approximately 70 to 85% of the deal as AAA-rated, leaving small tranche sizes available for investors looking for lower-rated investments with higher expected returns. In addition, call features in certain non-agency sectors can limit return upside. Whole loans can offer insurance companies a larger investable opportunity set in mortgage credit with favorable capital treatment. Insurance companies can partner with mortgage originators through “forward-flow” agreements to help meet monthly RWL investment targets rather than wait and compete for non-agency RMBS supply in securitization markets.

Key Takeaway

Non-agency RMBS continues to provide insurance companies with a liquid, customizable asset class to gain exposure to residential mortgage credit where it’s easier to capitalize on relative-value opportunities in the market. Residential whole loan investing from insurance companies is still heavily weighted toward the largest insurers, given larger transaction sizes and greater operational complexity. The largest insurers will continue to dominate RWL flows from insurance; however, participation from smaller insurance companies should increase as they explore opportunities to invest in RWLs.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.