The Evolving Homefront: Millennials Stay Put as Older Buyers Dominate the Market

July 24, 2025

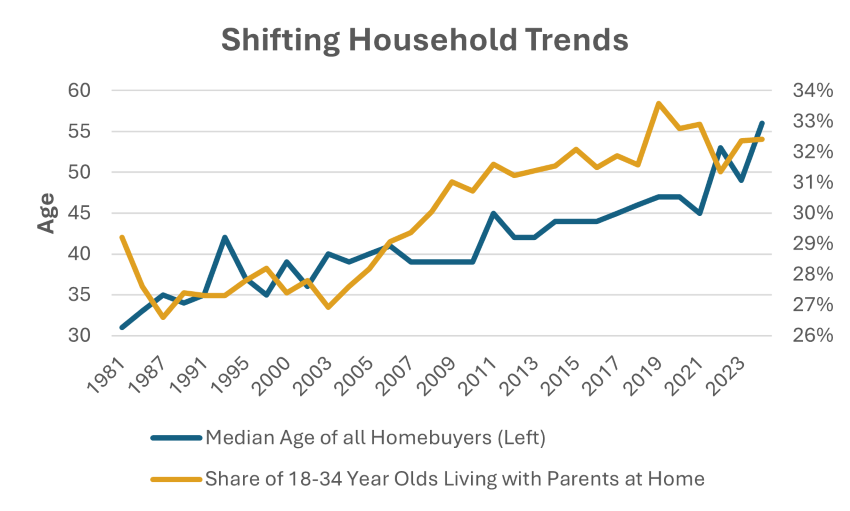

Homeownership in the U.S. is increasingly out of reach for many young adults, leading to significant shifts in housing trends. Nearly one in three young adults now live with their parents, according to U.S. Census Bureau data1 — a trend driven by rising home prices, mounting student loan debt, limited savings and a higher cost of living. Even as demand for housing remains strong, especially among those who postponed moving during the pandemic, affordability issues are sidelining many potential buyers.

While homeownership briefly rose during the era of historically low interest rates, the trend is reversing. The homebuyer affordability index declined sharply as mortgage rates and home prices surged, pushing the first quarter of 2025 homeownership rate down to 65.1% — a notable drop from 67.9% in the second quarter of 2020.2 Millennials, saddled with student loan balances and diminishing emergency savings, are especially hard-hit. The median age of first-time homebuyers climbed to a record high of 38 years in 2024, up from 35 just a year prior,3 reflecting how the market is increasingly pricing out younger adults.

This affordability squeeze fuels the demand for rentals. The share of new renter households climbed nearly 2% in 2024,4 with many young adults turning to the rental market as a more viable option. Renting remains more affordable than buying in many markets, supporting continued growth in both multifamily and single-family rental sectors. The median age of all homebuyers has also climbed, peaking at 56 in 2024, indicating that even seasoned buyers may carry mortgage debt into retirement.5 Adding to the financial burden, half of parents with adult children are providing regular financial support — up from 45% in 2023.6

Key Takeaway

While housing demand may soften due to economic pressures, strong rental demand is expected to continue, particularly among younger adults navigating high costs and limited financial flexibility. The rental market is becoming a more affordable housing alternative as new household formations shift to renters. Affordability challenges, lifestyle changes and demographic trends further support continued rental demand while vacancies decline in the multifamily and rental housing sectors. I expect favorable demographic trends will continue to support the multifamily and single-family rental home markets.

Sources:

1U.S. Census Bureau; as of November 2024

2Federal Reserve Bank of St. Louis – Homeownership Rate in the United States; as of 4/28/25

3,5Copyright ©2025 NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission.

4Arbor – Renters Account for Majority of Household Growth; 4/14/25

6CNBC - 50% of parents financially support adult children, report finds. Here’s how much it costs them; 3/25/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.