Pricing the Infrastructure Boom: Data Center Trends in Structured Markets

October 9, 2025

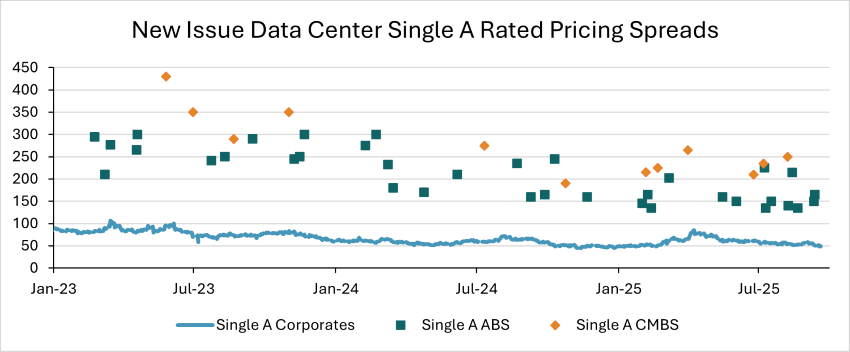

Data center issuance in the single-asset, single-borrower commercial mortgage-backed security (CMBS) and asset-backed security (ABS) markets has increased significantly over the last three years. Year-to-date transaction volume in 2025 reached $20.9 billion at the end of the third quarter, 75% more than full-year 2024 figures and almost double the volume in 2023.1 As the need for data centers continues to expand with increasing demands for data storage, computing power and the training and implementation of artificial intelligence software, as well as 5G, we can expect to see this asset class continue to gain ground in the securitized product league tables. With increased transaction volume, the market benefits from additional price discovery between the CMBS and ABS markets.

Today’s Chart of the Week highlights the relative value between new issue pricings of single-A-rated CMBS and ABS data centers. To date, CMBS has offered a pickup in spread to ABS in new issue transactions, though both CMBS and ABS remain attractive compared to similarly rated U.S. corporate bonds. Despite significant structural differences between the two structured markets (including the “master trust” framework in ABS and the prevalence of floating-rate deals in CMBS versus fixed-rate in ABS), the underlying collateral backing loans in either space is, theoretically, quite fungible for the appropriate assets. Last month’s pricing of a new ABS trust and retirement of a two-year-old CMBS loan with the same sponsorship demonstrated the potential benefits of this flexibility. The collateral in each of these transactions, located on the same data center campus in Phoenix, AZ with long-term leases to investment-grade tenants, differed most notably in their rate type with the ABS trust featuring a fixed-rate and the CMBS loan featuring a floating-rate. Compared to the previous 12 months of the floating-rate CMBS cost of funds, the total difference on a conversion to a fixed-rate ABS financing would have been approximately $5 million for similar collateral.2,3 As sponsors continue to search for diversification in funding sources while utilizing capital markets, we may see transfers of collateral between CMBS and ABS trusts.

Data center issuance has benefited from healthy market demand, and as pricing spreads compress across both ABS and CMBS markets, indicators point to continued supply. McKinsey projects that nearly $7 trillion in capital expenditures will be required for data centers by 2030,4 and securitized markets have met the expanding supply thus far. However, the asset class has yet to experience market fatigue and pronounced tiering between sponsors and collateral types, which is typical in the lifecycle of structured products. In addition, newer entrants to securitized markets may observe heightened sensitivity to headline risks. Oversaturation and quick shifts in market sentiment could lead to widening spreads and increased financing costs in the medium term.

Key Takeaways

While the popularity of data centers as a structured product asset class has developed relatively recently, I see healthy fundamentals in the near term for the sector. Relative value across both CMBS and ABS markets remains compelling, and opportunities for investors to express their convictions are expanding. Headline and headwind developments should be monitored closely, and some volatility could manifest in the short- and medium-term as the asset class matures.

Sources:

1DB Research

2Trepp

3Deal Documents

4McKinsey & Company – The cost of compute: A $7 trillion race to scale data centers; 4/28/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.