Can the Trump Administration Help Lower Mortgage Rates to Improve Housing Affordability?

December 4, 2025

After focusing its efforts on trade negotiations in the first half of 2025, the Trump Administration has recently increased its attention on the issue of affordable housing in the U.S. The Administration floated the idea in September that it could invoke the 1976 National Emergencies Act to combat a housing market that remains unaffordable for many Americans.1 In October, Federal Housing Finance Agency (FHFA) Director Bill Pulte announced that his agency is reviewing the loan-level price adjustments (LLPAs)—additional risk-based fees charged on conventional mortgages—with the intention of lowering borrowing costs for prospective homebuyers.2 This past month, Pulte added that officials are now evaluating how to make existing mortgages portable (i.e. the borrower can transfer the existing unpaid balance and interest rate on their current mortgage to purchase a new property), and whether to introduce a 50-year mortgage product.3

Although these recent announcements are a step in the right direction, their impact on improving housing affordability more broadly is questionable. Supply-side constraints on housing—such as building and zoning codes—are more effectively addressed at the state and local levels. On the demand side, while reducing LLPAs and introducing a 50-year mortgage product could reduce monthly mortgage payments for some borrowers, these changes would be less capital efficient for Fannie Mae and Freddie Mac and work against the Administration’s goal of privatizing the two government-sponsored enterprises. Portable mortgages would be most beneficial to existing homeowners who have already locked in low borrowing costs.

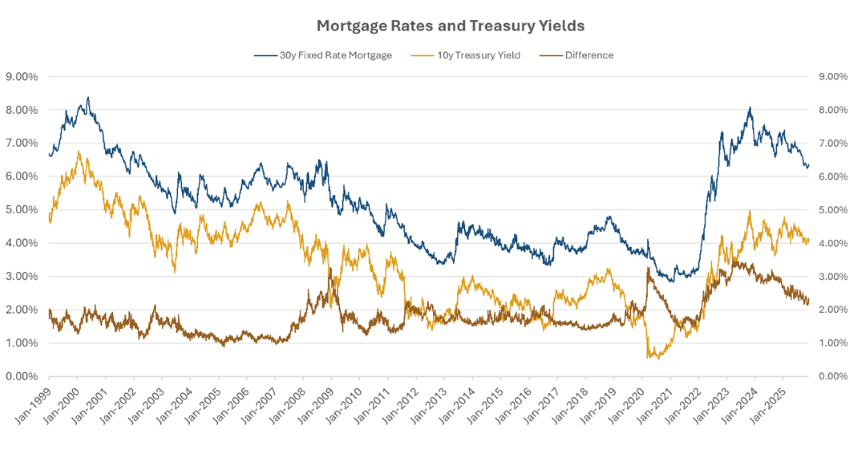

Today’s Chart of the Week compares the average 30-year mortgage rate with the 10-year Treasury yield. Lowering Treasury yields and reducing the spread between mortgage rates and longer-term Treasury yields would accomplish the Administration’s objective of improving housing affordability more broadly. However, longer-term Treasury yields face resistance to falling below 4% with inflation continuing to come in at 3%. Additionally, the spread between mortgage rates and Treasury yields has remained wide over the past several years with the Federal Reserve (Fed) passively reducing its mortgage-backed securities portfolio.

Key Takeaway

The Administration’s attempts to exert influence over the Fed—perhaps most effectively with the upcoming selection of its new chairman—have increased the probability that future monetary policy will be focused on driving Treasury and mortgage rates lower. More extraordinary policies such as quantitative easing and yield curve control cannot be ruled out as future policy tools attempting to achieve the Administration’s objectives.

Sources:

1Realtor.com – How a National Housing Emergency Could Open More Doors for First-Time Buyers; 9/10/25

2Housingwire – Pulte says LLPA fees under review, signals relief for borrowers; 10/23/25

3CNN – The Trump administration is ‘actively evaluating’ portable mortgages. What you need to know; 11/13/25

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.