More to Celebrate! PMUBX Turns Five

September 27, 2023

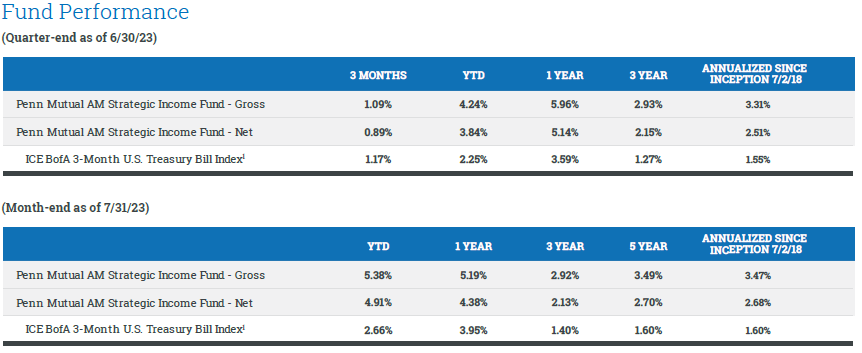

PMAM is pleased to announce that the Penn Mutual AM Strategic Income Fund (PMUBX) recently celebrated its 5-year anniversary, achieving this milestone track record among other accolades.

The Fund was launched in July 2018 and has successfully delivered consistent, value-added results for investors during a period of elevated interest rate volatility, including a record-setting bond market selloff in 2022. Our disciplined, value-based approach helped to preserve capital during a period when many fixed-income managers struggled to keep pace.

1. What’s compelling about PMUBX? Why should investors consider investing in PMUBX?

The Fund’s flexibility to invest anywhere along the yield curve and across the spectrum of fixed-income sectors enables our investment team to take advantage of, what we believe to be, the most attractive fixed-income investment opportunities. Our seasoned portfolio management team — with more than 75 years of combined experience — consists of managers with depth, breadth and experience to create a collaborative investment culture focused on uncovering and delivering value for our clients. Our team’s demonstrated ability to balance high conviction ideas against prudent risk management and diversification has the potential to create long-term value for investors.

2. What has contributed to the Fund’s outperformance since inception?

The Fund’s strong results have been driven by our disciplined and repeatable investment process — a process which utilizes a relative-value based framework to evaluate new investment opportunities. In our view, the investment team’s ability to move quickly to capitalize on new investment opportunities has also been a key differentiator to generate alpha for our clients. During the period of record-low interest rates in 2020 and 2021, the investment team did not fall into the trap of reaching for yield but stayed true to our focus on generating attractive risk-adjusted returns.

3. How may the Fund’s active approach create value for investors in the current environment?

Our data shows that the sharp increase in yields since the Federal Reserve (Fed) started hiking short-term rates 18 months ago has created the most attractive entry point for high quality fixed-income investments since the Global Financial Crisis. In our opinion, the deep inversion of the yield curve today provides opportunities to source conservatively positioned (both in terms of credit quality and interest rate risk) fixed-income investments which offer significant total return potential with, what we believe to be, limited downside risk. Our active management approach will continue to be focused on identifying, in our view, the best balance of return and risk as the Fed nears the end of its current rate-hiking cycle.

Total Fund Operating Expense: 0.77%

Total Fund Operating Expense: 0.77%

Performance data shown represents past performance and is not a guarantee of future results. Investment performance and principal value will fluctuate, so when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please call 877-PMA-MLLC (877-762-6552).

¹There was a change in Penn Mutual AM Strategic Income Fund’s benchmark, effective January 1, 2023, from the ICE BofA 3-Month USD LIBOR Index (which LIBOR Index will be discontinued beginning on or around June 30, 2023 in connection with the discontinuation of the London Interbank Offered Rate) to the ICE BofA 3-Month U.S. Treasury Bill Index.

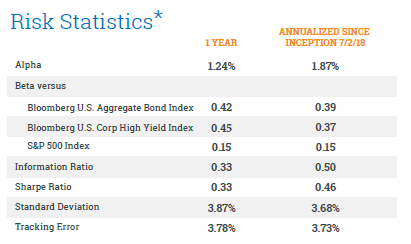

*Unless otherwise indicated, all data is reported as of July 31, 2023 and is not a representation of current or future data. Holdings and allocations are subject to change.

Risk statistics are shown as supplemental information only. Risk statistics are derived using gross returns.

Visit our website here to learn more about the PMUBX.

For more information about the Fund, contact Chris Fanelli, managing director, business development, at fanelli.chris@pennmutualam.com or (609) 306-7034.

To download this announcement, please see the attachment below.

About PMAM

With approximately $32 billion in assets under management as of July 31, 2023, Penn Mutual Asset Management ("PMAM") is an institutional asset management firm located just outside of Philadelphia, PA that has been offering investment solutions and client-focused services since 1989.

Follow the latest news and insights from the PMAM investment team at The Long View, as well as on LinkedIn and X (formerly known as Twitter).

_________________________________________________________________________________

Important Information

The information contained herein has been prepared solely for informational purposes. It is subject to change without notice and it is not intended as an offer or solicitation of the Funds nor any other products or services offered by PMAM. Please note this information has been prepared as a general summary without consideration of any specific investors, thus please do not use this material solely to make any investment decisions. All investors should always refer to the prospectus to learn more about the Fund before investing.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For the full prospectus, which contains this and other information about the Fund, please visit www.pennmutualam.com. Investors should read the prospectus carefully before investing.

The Fund is distributed by SEI Investments Distribution Co. (SIDCO) at 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Penn Mutual Asset Management.

Important Information: Investing involves risk, including possible loss of principal. The Fund’s other investment risks include, but are not limited to, interest rate, inflation, credit and default risk associated with fixed income securities. In addition, high yield bonds have a higher risk of default or other adverse credit events. Other risks include, but are not limited to, equity risk, preferred stock risk, allocation risk, conflicts of interest risk, counterparty credit risk, foreign investments risk, high portfolio turnover risk, liquidity risk and volatility risk. There is no guarantee the Fund will achieve its stated objective. Indices are unmanaged and do not include the effect of fees. One cannot invest directly in an index.

Definitions

Alpha – A measure of the performance of an investment against a market index or benchmark which is considered to represent the market’s movement as a whole.

Beta – A measure of the volatility, or systematic risk, or a security or a portfolio in comparison to the market as a whole. A beta of 1 indicates that the security’s price moves with the market. A beta of less than 1 means that the security is theoretically less volatile than the market and a beta greater than 1 indicates that the security’s price is theoretically more volatile than the market.

Duration – A measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

Information Ratio – A risk-adjusted performance measure. The information ratio is a special version of the Sharpe Ratio in that the benchmark doesn't have to be the risk-free rate.

Sharpe Ratio – A measure for calculating risk-adjusted return. The Sharpe ratio is the average return earned in excess of the risk-free rate per unit of volatility or total risk.

Standard Deviation – A measure of the dispersion of a set of data from its mean. If the data points are further from the mean, there is higher deviation within the data set.

Tracking Error – A measure of volatility of excess returns relative to a benchmark.

Bloomberg U.S. Aggregate Bond Index – An index that is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Bloomberg U.S. Corp High Yield – An index measures the USD-denominated, high-yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition, are excluded.

ICE BofA 3-Month U.S. Treasury Bill Index – This index measures the performance of a single issue of an outstanding treasury bill which matures closest to, but not beyond, three months from the rebalancing date. The issue is purchased at the beginning of the month and held for a full month; at the end of the month that issue is sold and rolled into a newly selected issue.

S&P 500 Index – An index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.