Best of 2023: Top Chart of the Week Posts

December 28, 2023

Over the course of the year, our team of talented investment professionals has remained steadfast in identifying and thoroughly researching impactful trends within the financial markets. We remain committed to sharing valuable insights with you each week in our Chart of the Week blog posts. Before embarking on a new year, we wanted to reflect and highlight the most viewed posts of 2023. We hope you enjoy them, once again!

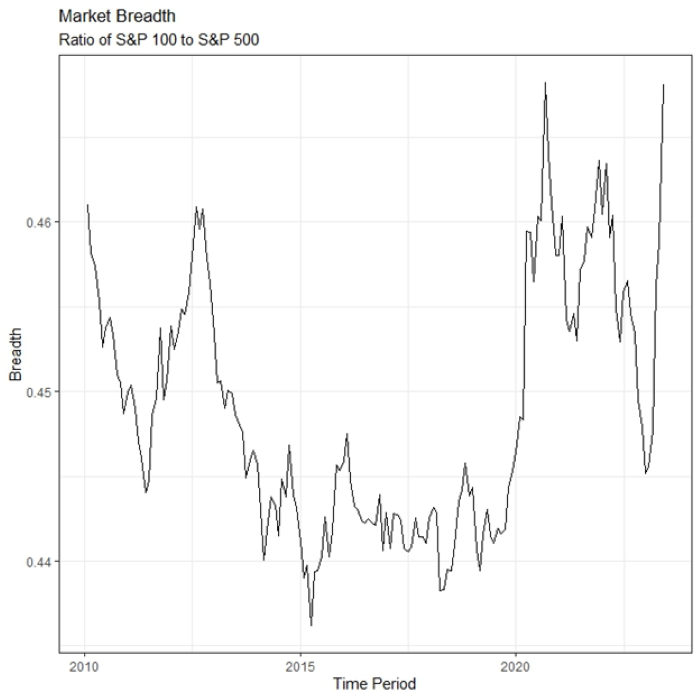

Source: Bloomberg

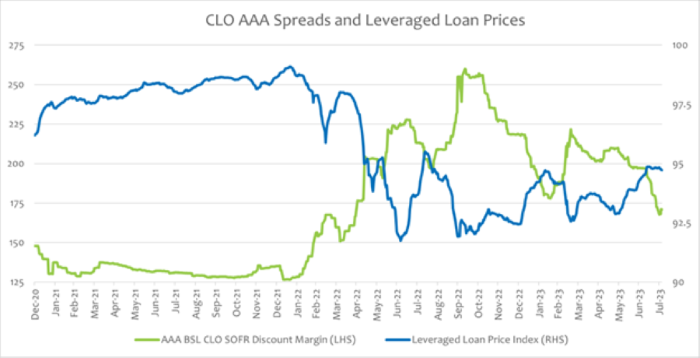

2. New CLO Issuance Continues to Slow

Source: J.P. Morgan CLOIE Index; Bloomberg

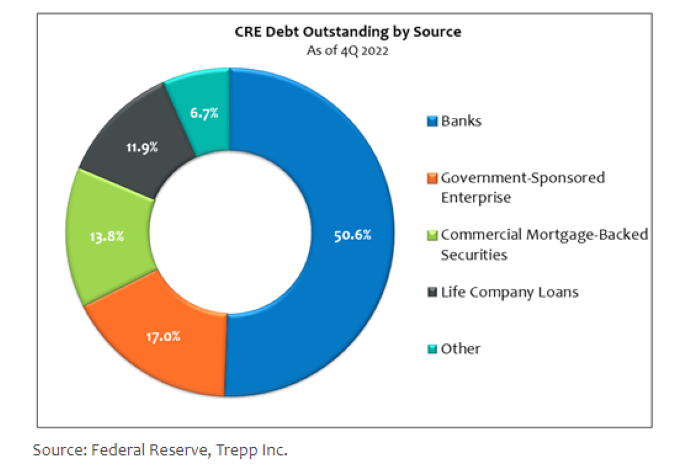

3. Is Office Real Estate the Next Shoe To Drop for Small and Midsize Banks?

Source: Federal Reserve, Trepp Inc.

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.