Best of 2025: Top Chart of the Week Posts

December 30, 2025

.jpg)

Throughout 2025, our team of investment professionals has remained dedicated to conducting thorough research and analysis of the trends shaping today’s financial markets. Each week, we have shared these perspectives through our Chart of the Week blog series, offering deeper insights into prominent themes, evolving market conditions and the forces influencing investor sentiment.

As the year concludes, we’re taking a moment to highlight the most viewed posts of 2025. We invite you to revisit these insights and trust that you will find continued value in the perspectives they offer.

Source: National Retail Federation

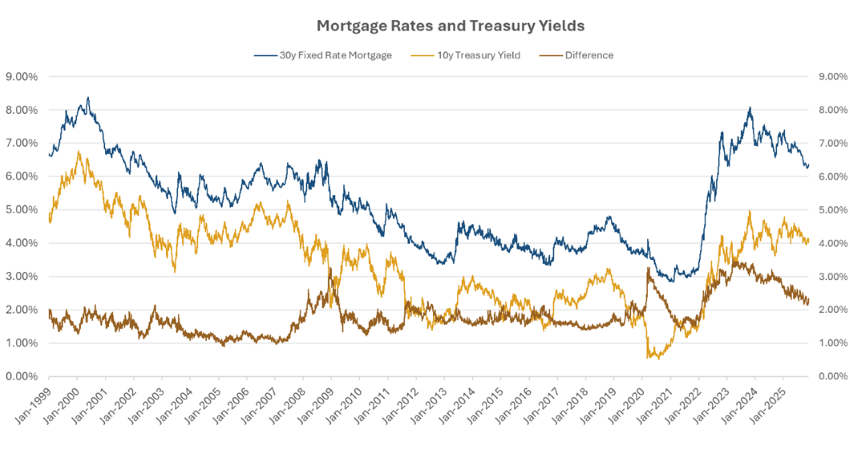

2. Can the Trump Administration Help Lower Mortgage Rates to Improve Housing Affordability?

Source: Bloomberg

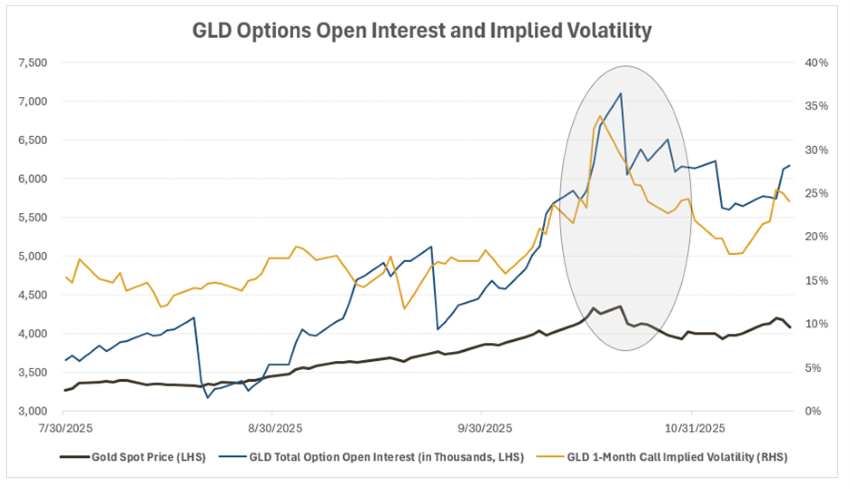

3. Inside Gold’s Retreat: What the Options Market Revealed

Source: Bloomberg

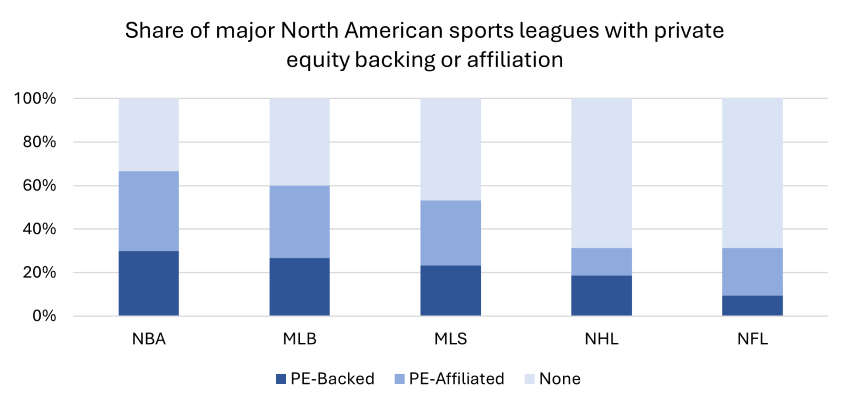

4. Private Equity is Betting Big on Professional Sports

Source: PitchBook Data, Inc. – Private Capital in Sports: PE Is Up to Bat; Data as of 5/20/2025

This material is for informational use only. The views expressed are those of the author, and do not necessarily reflect the views of Penn Mutual Asset Management. This material is not intended to be relied upon as a forecast, research or investment advice, and it is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

Opinions and statements of financial market trends that are based on current market conditions constitute judgment of the author and are subject to change without notice. The information and opinions contained in this material are derived from sources deemed to be reliable but should not be assumed to be accurate or complete. Statements that reflect projections or expectations of future financial or economic performance of the markets may be considered forward-looking statements. Actual results may differ significantly. Any forecasts contained in this material are based on various estimates and assumptions, and there can be no assurance that such estimates or assumptions will prove accurate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. All information referenced in preparation of this material has been obtained from sources believed to be reliable, but accuracy and completeness are not guaranteed. There is no representation or warranty as to the accuracy of the information and Penn Mutual Asset Management shall have no liability for decisions based upon such information.

High-Yield bonds are subject to greater fluctuations in value and risk of loss of income and principal. Investing in higher yielding, lower rated corporate bonds have a greater risk of price fluctuations and loss of principal and income than U.S. Treasury bonds and bills. Government securities offer a higher degree of safety and are guaranteed as to the timely payment of principal and interest if held to maturity.

All trademarks are the property of their respective owners. This material may not be reproduced in whole or in part in any form, or referred to in any other publication, without express written permission.